Summer is traditionally the off-season for pork consumption, yet this summer the pork prices are far from "calm".

On July 29th, in a fresh supermarket in Changping District, Beijing, a pound of domestic grain-fed beef leg meat was priced at 34.9 yuan, while the adjacent domestic grain-fed lean pork was priced at 33.8 yuan per jin. A duty manager at the supermarket told the reporter that typically beef prices are higher than pork, but recently the gap has indeed been significantly narrowing. The reason is that the wholesale price of beef has dropped, while the wholesale price of pork has increased considerably.

The Xinmou Network pig price index shows that currently, the live pig prices in Guangdong, Shandong, Anhui, Zhejiang, and 10 other provinces and cities have broken through the 10 yuan per jin mark, while the live cattle prices are just over 10 yuan per jin.

"The most difficult cold winter has passed," many pig farmers have lamented in the face of the continuous rise in the market this year. At the same time, the positive effects of the sustained recovery in pig prices are also reflected in the performance forecasts of pig farming enterprises in the first half of the year. The First Financial reporter noticed that in the first half of the year, many domestic pig enterprises have significantly reduced losses or even turned losses into profits.

However, how long this long-awaited upward trend can last is still unknown. Many industry insiders have expressed a "cautiously optimistic" attitude towards the later pig market in interviews, warning farmers not to blindly expand production and to be alert to the risk of a sharp drop after a surge.

Pig enterprise performance is in the red.

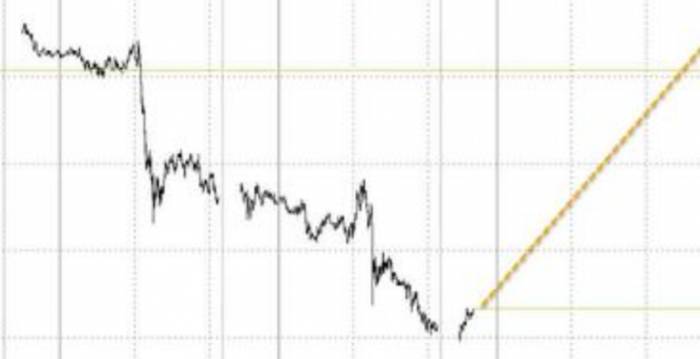

The First Financial reporter noticed that since late May, pig prices have ended the previous four months of hovering around 15 yuan per kilogram and have begun to recover and rise.

According to the survey results of the National Bureau of Statistics on 200 agricultural product wholesale markets in the country, from January to April of this year, the wholesale market price of live pigs (medium size) was in the 15 yuan per kilogram range. But in May, the stalemate was broken, and this figure became 16.21 yuan per kilogram. By June, it reached a new level, reaching 17.89 yuan per kilogram.

Although July has not yet ended, it is almost inevitable that pig prices will "break 9 and rush to 10". Data from the China Pig Raising Network shows that the price of foreign three-element pigs is 19.33 yuan per kilogram, a year-on-year increase of 27.76%. Among the 31 provinces, autonomous regions, and municipalities directly under the Central Government that can be monitored nationwide, the pig prices in 20 regions have reached 19 yuan per kilogram and above, accounting for more than 60%. Hainan pig prices are at the top of the list, reaching 22.49 yuan per kilogram.

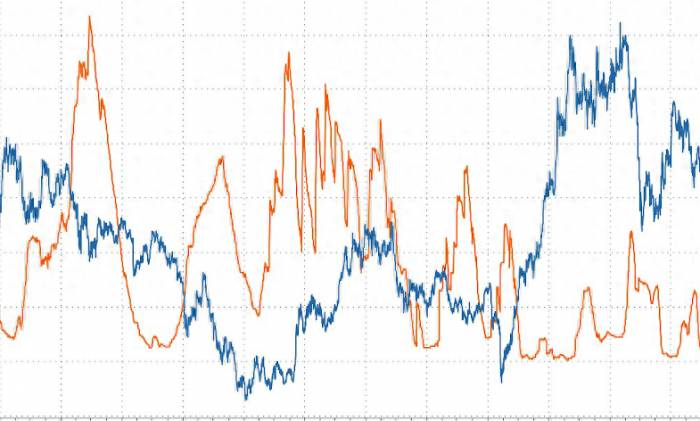

Xu Hongzhi, a senior analyst at the Bric Agriculture Big Data, analyzed to the First Financial reporter that among the many factors affecting pig prices, the role of the supply side is far greater than that of the demand side.Pork Price Trend Chart Data Source: Zhuochuang Information, Monitoring Information from the Ministry of Agriculture and Rural Affairs

Xu Hongzhi believes that as summer begins, the impact of the pig production capacity reduction that has been ongoing for 16 consecutive months is fully unleashed. The market's supply capacity for fattening pigs has seen a continuous decline, triggering a rapid increase in prices. At the same time, due to the low prices in the early period, the cost of purchasing piglets was low at that time. Coupled with the subsequent price increase, the larger the pigs are raised, the more profitable they become. Therefore, some farmers, stimulated by profits, are holding back and engaging in secondary fattening, further causing a structural imbalance in the market supply of pigs. These factors together have led to the "off-season not being off" in pig prices, which have been rising continuously since May and reached a new high in July.

Monitoring data from the Ministry of Agriculture and Rural Affairs shows that on July 29, the average price of pork in the national agricultural product wholesale markets was 25.35 yuan/kg. Compared with January 29, when the average pork price was 20.62 yuan/kg, the price increased by more than 20% in half a year.

Zhuochuang Information's pig market analyst, Li Jing, believes that in addition to the low number of pigs being sold and the reduction in production caused by pig diseases, which support the underlying logic of rising pig prices, the reduction of pigs from outside the province in the South China region has made the pig prices in this area strong this month. At the same time, heavy rainfall in many parts of the country has affected the delivery and transportation of pigs, also exacerbating the supply gap of pigs in a certain period.

Looking at the performance forecasts for the first half of the year announced by several pig farming companies, the continuous rise in pork prices since May has brought a lot of surprises to the second quarter financial reports, becoming a key period for significant profit growth.

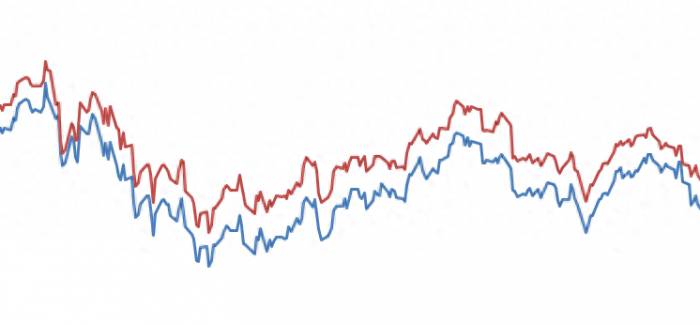

Some pig farming listed companies' performance forecasts for the first half of this year Data Source: Boya and Xun, Company Announcements

Muyuan Foods, a giant pig farming company with a market value of tens of billions, announced its performance forecast, which shows that the net profit attributable to shareholders of the listed company is expected to be between 700 million and 900 million yuan in the first half of the year, a year-on-year increase of 125.19% to 132.38%. Regarding the reasons for the change in performance, Muyuan Foods stated that the main reason for turning a profit from a loss is that the company's pig sales volume and the average sales price of pigs in the reporting period have increased compared to the same period last year, and the cost of pig farming has decreased compared to the same period last year.

The "counter-attack" in performance is obviously not only Muyuan Foods. Another giant pig farming company with a market value of tens of billions, Wens Food, announced its performance forecast, which shows that Wens Food is expected to achieve a net profit attributable to the parent company of 1.25 billion to 1.5 billion yuan in the first half of the year, compared to a loss of 4.689 billion yuan in the same period last year. "Both quantity and price are rising" explains Wens Food's pig farming business turning a profit in the first half of the year. According to the announcement, the company sold 14.3742 million pigs in the first half of the year, a year-on-year increase of 21.96%, and the average sales price of pigs was 15.32 yuan/kg, a year-on-year increase of 5.09%.

It is worth noting that the first quarter report this year shows that Wens Food's net profit was a loss of 1.236 billion yuan, but by the mid-report, it was able to achieve a net profit of 1.25 billion to 1.5 billion yuan, a "turnaround". This means that the company made a profit of nearly 2.5 billion to 2.7 billion yuan in the second quarter, completely ending the situation of large losses in the mid-report for three consecutive years from 2021 to 2023.

Expand production or repay debtFor practitioners and investors involved, mastering the "pig cycle" is an important rhythm for balancing profits and losses. Like the business cycles of other industries, the pig cycle will go through a cyclical process of "supply shortage, price rise - expansion of production capacity, oversupply - price drop, contraction of production capacity - supply shortage, price rise."

Faced with the long-awaited continuous rise in pig prices, will pig farming enterprises with advantageous breeding resources increase investment and bet on expansion? In response, Xu Hongzhi stated that for some pig enterprises, expansion is not in the future tense but in the present tense. "Including leading enterprises such as Muyuan, the inventory of breeding sows has increased to varying degrees over the past year. In addition, most enterprises have insufficient capacity utilization and idle pig farm equipment. Even if pig enterprises do not expand production, just by fully utilizing the existing capacity, it is enough to increase the actual market supply capacity by 10% to 20%."

However, before considering expansion, addressing the issue of high asset-liability ratios may be prioritized in the budget. This has been mentioned in recent investor relations activities of the three major pig farming enterprises.

On July 29, when a First Financial reporter inquired about the expansion situation of Muyuan Foods as an investor, the company's securities department responded that they would reasonably plan the number of breeding sows based on the external environment and production and operation conditions. Previously, Muyuan Foods publicly stated that with the improvement of the pig market and the continuous decline of breeding costs, the company's profitability and cash flow situation will be significantly improved this year, providing an objective basis for reducing the scale of debt. The company will continuously reduce the overall debt scale and leverage level on the basis of stable operation, and optimize the debt structure and financial situation.

"In recent months, the rise in pig prices has gradually covered the company's production costs. But overall, the time to achieve profitability is still short, and the company will prioritize repaying certain interest-bearing debt, reducing the asset-liability ratio, and ensuring the safe operation of the company. At the same time, the company will focus on cost control and efficiency improvement with 'reducing costs and ensuring profitability' as the primary goal. After profitability effectively compensates for past losses, then consider expanding the scale." Wen's Group publicly stated at a recent securities strategy meeting.

Looking forward to the pig market, Li Jing believes that the overall market will undergo a strong adjustment in August and September this year, and it may enter the end of high-position oscillation in October, and from November to December, it may gradually appear in a state of supply exceeding demand, and pig prices may enter a downward trend. Among them, pig diseases and concentrated heavy rainfall are variables worth paying attention to, and they are currently controllable.

Xu Hongzhi also believes that the second half of the year will show a trend of oscillating upward. The reason is, on the one hand, the results of capacity reduction will gradually emerge. The decline in breeding sows that started in 2023 will be transformed into a continuous reduction in the supply of fattening pigs in the market in 2024, driving up prices. On the other hand, under the stimulation of profits, market speculation behaviors such as pressure yard and secondary fattening are becoming increasingly active, which will cause a structural shortage of fattening pig supply in the early stage, and a structural surplus of supply when concentrated on the market in the later stage.

Such volatility in pig prices will be significantly amplified. In terms of imports, the rise in pig prices in the past few months has rapidly improved the profit of pork imports, and it is expected to promote a significant increase in imports in the fourth quarter, which will help to stabilize domestic market prices.

Xu Hongzhi reminds that under the current background of the entire industry being profitable, the industry should seize the time window of the profit cycle, actively adjust the business development strategy, change from competing for scale to competing for costs, reduce costs and increase efficiency in links such as pig breeding, feeding efficiency, and disease prevention and control, and truly reduce the breeding costs. This is the fundamental way to deal with the downturn of the pig cycle. At the same time, avoid blind expansion, pay high attention to the management of the capital chain, and reduce debt risks.

Post a comment