After the market closed, a piece of news went viral, a game-changing positive development, saying that we are preparing to lower the existing mortgage interest rates of 37.8 trillion, possibly in two steps, with the first step likely to be realized soon.

There is also news that the once-great figure, Xu Xiang, has recently gotten into trouble again. Tonight we will discuss two topics: first, how to view this game-changing positive development and its impact on the stock market; second, my personal views on Xu Xiang's matter.

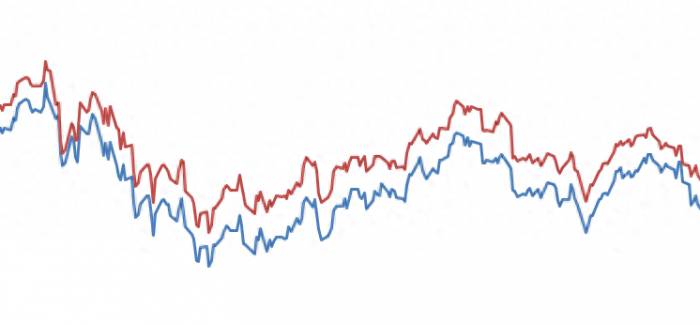

Regarding the reduction of the existing real estate mortgage interest rates of 37.8 trillion, it has been rumored for a long time. The sharp rise last Friday was due to this reason. However, since it was not realized on Monday, the market retreated quickly.

Now that it is reported again, the market will certainly respond positively, but the effect will definitely be less than last Friday because everyone already has expectations. The benefit is definitely for sectors other than banks, as banks will have to give concessions. But this concession is like meat that rots in the pot, and it is very obvious for boosting consumption and the vitality of the entire economy.

So it is bearish for banks and bullish for directions other than banks. The most beneficial ones might still be the short-term hot-played, elastic technology directions. When the market rises, look at technology; when it fluctuates, look at thematic investments; when it falls, look at high dividend stocks. This was our catchphrase in the early period.

Secondly, regarding Xu Xiang's matter, it is actually an old issue. However, the impact of this matter is very, very significant. Why? We used to say that manipulating stock prices had a considerable legal risk, but in recent years, the legal risk has become even greater. In the past, everyone did this for wealth, but now, with the legal risk greater than before, the difficulty of seeking wealth has also increased.

Looking at it from three levels: the first level, the legal aspect is now stricter, which means the time spent on the sewing machine is longer, no doubt about it, I am quite familiar with it! The second level, it used to be one fine for three, but now after the authorities have acted, there will be endless civil liabilities in the future. There are too many shareholders, and it is not enough to compensate them. Basically, it will undoubtedly lead to bankruptcy; the third level, Boss Xu has closed the shop for us, and in the future, companies like this, cases like this, such lawsuits are a sure win and will not lose.

Moreover, in addition to listed companies, there are manipulative market makers, and the probability of obtaining compensation is even greater. I have a special video on this topic on Wednesday, and everyone can go and watch it themselves.

In summary, the market has already broken through the 2800 point mark for the second day. If it does not recover on Thursday, it will be an effective break. Therefore, Thursday is very crucial. The news of this game-changing positive development is indeed very, very crucial for the market at this time. I think there might be a correction on Wednesday, but it is bearish for banks, and everyone should understand this. The index is weak, but individual stocks dominate. Stricter regulation is good for investors in the long run, and we definitely support it, looking forward to a red Thursday.

Post a comment