How Much Will the Global Development of ESG Be Affected?

Based on past events and campaign platforms, the additional emissions during Trump's "new term" would offset more than twice the total amount of energy saved by the global deployment of wind, solar, and other clean technologies over the past five years.

As a leader in the global economy, changes in the United States' ESG policies will have a significant impact on the international community. If the U.S. government adopts a more conservative stance on ESG, it may have a certain demonstration effect on the policies of other countries, especially those with economic and cultural similarities to the United States.

However, despite the potential adjustments to ESG policy direction by a conservative U.S. government, market forces, international trends, and the independent choices of companies and investors mean that the foundation of the ESG concept will not be easily shaken.

Regions such as the European Union continue to vigorously promote ESG standards, with the puzzle pieces on the blueprint of the EU's sustainable regulatory system being continuously improved and matured, impacting both within and outside the EU. Even if U.S. policies change, the development of the ESG concept globally may still continue.

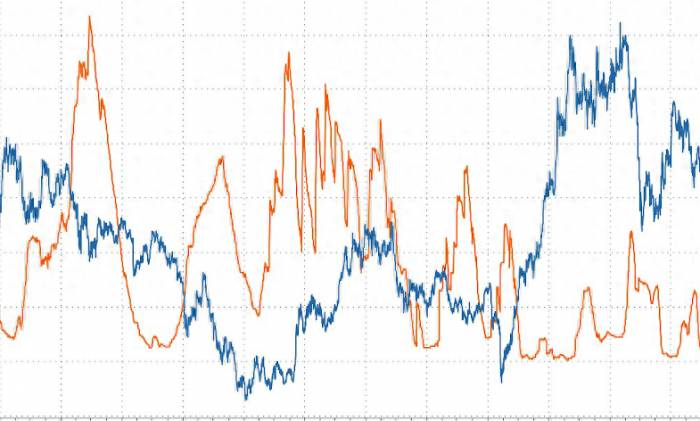

At the same time, market reactions are expected to be more diverse and complex. According to the latest reports from S&P Global and MSCI, the total global ESG investment has increased from $30 trillion in 2018 to $55 trillion in 2023, with its share of total global investment rising from 10% to 20%. This trend indicates that more and more investors are putting their funds into projects with social and environmental responsibilities.

Even in the United States, the influence of the president's executive orders is limited to the investment behavior of pension funds under government jurisdiction, while other private funds still have their own power to make ESG investment decisions.

The entities involved in ESG and global climate governance are becoming increasingly diverse, with non-state actors such as cities, companies, and civil society playing an active role. Global climate governance used to be mainly driven by governments, with parties formulating responsibility allocation and international cooperation plans within the United Nations framework through international negotiation processes. With the advancement of the Intergovernmental Panel on Climate Change (IPCC) on climate change science and the United Nations Framework Convention on Climate Change (UNFCCC) on political processes, the continuous development of low-carbon technologies and industries, and the increasing recognition of the economic and social benefits of addressing climate change.

Many U.S. states, high-tech giants, and even some traditional energy companies have expressed their willingness to continue supporting the control of greenhouse gas emissions and the development of renewable energy.

Therefore, the global trend of ESG sustainability and climate governance will continue to move forward, although it may be somewhat affected by the change in the U.S. government's stance.What are the current drivers for ESG in businesses?

There are several driving factors behind businesses adopting ESG (Environmental, Social, and Governance) principles in their operations and investments:

1. Corporate Voluntary Adoption: Some companies with significant influence in the international market adopt ESG standards to reflect their responsible values, enhance their brand image, and improve market competitiveness.

2. Jurisdictional and Regulatory Trends: There is a growing trend towards mandatory sustainability and climate governance disclosure requirements in various jurisdictions and market regulations.

3. Investor Advocacy: Many large investment institutions are signatories to the United Nations Principles for Responsible Investment (UN PRI), which follow ESG as a criterion for assessment and investment. Investee companies are influenced by the ESG frameworks of their investors.

4. Consumer Demand: As consumer awareness and mainstream interest in corporate social responsibility and climate governance increase, products and services that adopt ESG standards gain more recognition.

In terms of investment, over 5,370 institutions have signed the United Nations Principles for Responsible Investment (UN PRI), managing assets totaling more than $121 trillion, accounting for more than half of the global professional asset management scale. This demonstrates the significant influence and recognition of UN PRI in the global investment field. Signatories of UN PRI include pension funds, insurance companies, sovereign funds, development funds, investment management institutions, and service providers from around the world, who commit to integrating environmental, social, and corporate governance (ESG) factors into their investment strategies, decision-making processes, and active ownership.

From a regulatory perspective, a total of 134 stock exchanges worldwide have joined the United Nations Sustainable Stock Exchanges Initiative (SSE Initiative), with 38 exchanges having mandatory ESG listing requirements and 73 exchanges providing written guidance on ESG reporting.

The Broad Effects of ESG through the Value Chain

Sustainable disclosure and practices chosen by market regulation and leading companies in the supply chain have the most extensive and realistic impact on businesses as a driving force.Taking the European Union as an example, 2024 will mark the first reporting period for the EU's Corporate Sustainability Reporting Directive (CSRD). According to the regulations, large public interest entities in the EU with an average number of employees exceeding 500 on the balance sheet date of FY2024 will be required to disclose annual sustainability-related information in detail, in accordance with the European Sustainability Reporting Standards (ESRS).

The CSRD expands the scope of companies obligated to disclose sustainability-related information to 50,000, introduces the requirement for sustainability assurance at the 'limited assurance' level, and strengthens the standardization of reporting content (by establishing ESRS).

The CSRD also brings non-EU (third-country) companies under its regulatory scope—requiring third-country companies that have a net turnover of more than €150 million in the EU in the last two financial years and have at least one qualifying subsidiary or branch in the EU to disclose sustainability-related information according to specific standards in FY2028 (reported in 2029). This standard will cover many Chinese companies, and this is just the direct impact of CSRD on Chinese enterprises.

According to the requirements of the General Sustainability-related Disclosures (ESRS 1), the reporting companies should include 'value chain information' in their sustainability reports, that is, information on significant impacts, risks, and opportunities related to the upstream and downstream supply chain and direct or indirect business of the reporting company. Therefore, large EU companies under the jurisdiction of CSRD will demand ESG data from upstream and downstream enterprises. The multiplier of 50,000 companies and their upstream and downstream value chain enterprises represents a huge number of entities subject to CSRD regulatory requirements.

This ESG pressure from the value chain has already been transmitted to Chinese companies—where the relevant requirements are gradually becoming one of the conditions for establishing long-term cooperation with large EU brands. Compared to directly disclosing sustainability-related information in accordance with CSRD, this indirect transmission has a more urgent and broader impact on Chinese companies.

In addition, another upcoming EU sustainable regulatory law will have a greater (direct and indirect) impact on Chinese companies than CSRD.

In February 2022, the European Commission proposed the Corporate Sustainability Due Diligence Directive (CSDDD), which was passed by the European Parliament on April 24, 2024, with the intention of legally clarifying the responsibility of large EU companies to eliminate human rights violations and environmental damage in their supply chains, in order to accumulate more effective information and data, and to identify sustainability risks and (adverse) impacts in the value chain. The CSDDD is expected to be implemented in the second half of 2026 at the earliest, and by 2029, its scope will cover a large number of non-EU companies.

The formal adoption of the CSDDD marks an important step for the EU in corporate sustainable accountability, requiring companies to take responsibility for the negative impacts of their own activities, the activities of their subsidiaries, and the activities of their business partners in their value chain.

The CSDDD requires relevant EU and non-EU companies to conduct 'due diligence' on the 'adverse effects' on human rights and the environment of their own operations, the operations of their subsidiaries, and the operations of their 'value chain'. The 'value chain' refers to the activities related to the production of goods or the provision of services by a company, including the development of products or services, the use and disposal of products, and the related activities of 'established business relationships' upstream and downstream. The concept of 'value chain' greatly expands the organizational and business scope of corporate due diligence. Sustainable due diligence focuses on sustainability factors and is a systematic mechanism for effectively identifying, managing, and disclosing 'adverse environmental impacts' and 'adverse human rights impacts' caused by violations of international environmental or human rights conventions.

The increasing maturity of EU sustainable regulation and Chinese enterprisesCSDDD is interconnected and complementary to other sustainable regulatory frameworks within the EU, with a key focus on supplementing CSRD and SFDR. Compliance with the disclosure regulations of SFDR and CSRD is predicated on conducting sustainable development due diligence to identify, prevent, and mitigate adverse sustainability impacts. The due diligence process and outcomes are also central to sustainable information disclosure.

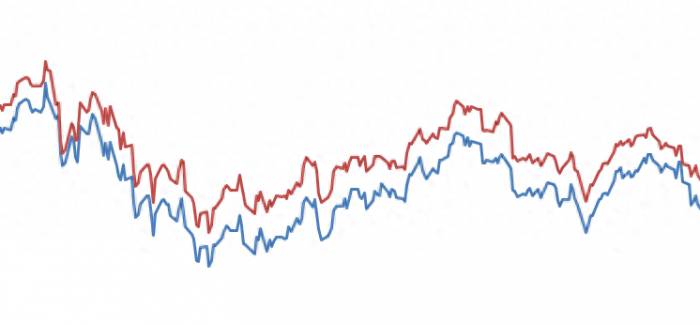

The introduction of CSDDD will add another important piece to the puzzle of the EU's sustainable regulatory system blueprint. The increasingly mature and comprehensive EU sustainable regulatory framework is not only impacting within the EU but also, with the central positioning and significant influence of large EU companies and brands in the global supply chain, the sustainable regulatory pressure they face will inevitably be transmitted upstream and downstream through the supply chain, enhancing the substance of their sustainable management practices.

Through extensive supply chains and complex value chain relationships, ESG pressures permeate and are transmitted at various levels. Many enterprises may thus fall within the scope of ESG influence.

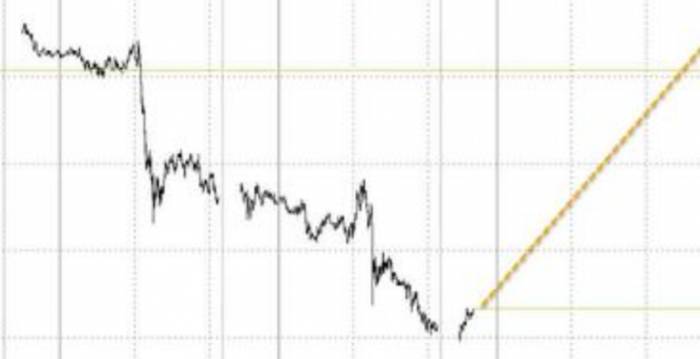

In 2020, China first overtook the United States to become the EU's largest trading partner, a position it maintained until 2023. According to statistics, in 2023, the trade volume between China and the EU was 5,646.798 billion yuan, of which China's exports to the EU were 3,743.441 billion yuan, and imports from the EU were 1,903.357 billion yuan.

Chinese enterprises with overseas business are pioneers in transitioning to ESG. Rapidly responding to ESG demands from overseas policies and clients has become a bonus in the fierce market competition to secure orders and a direct driving force for ESG initiatives. An increasing number of international clients are including sustainability dimensions in their supplier assessment forms, such as a company's CDP (Carbon Disclosure Project) rating, EcoVadis rating, and Science-Based Targets Initiative (SBTi).

In the past two years, with the tightening of EU ESG policies, companies going abroad often receive due diligence requests from major overseas clients, usually in the form of questionnaires or third-party audits to investigate ESG practices. Faced with the pressure of customer orders, standardized ESG work has become more urgent, and ESG has gradually become a required answer for companies going global.

Rapid Progress of China's ESG Policies

In addition to the ESG pressure transmission from investors and international value chains, Chinese companies are more influenced by domestic policies. In 2024, China introduced a series of ESG-related policies.

On May 1st, the three major stock exchanges in Shanghai, Shenzhen, and Beijing officially released the "Guidelines for Sustainable Development Reporting of Listed Companies" (hereinafter referred to as the "Guidelines"), which were officially implemented, marking the formal entry of ESG information disclosure into the era of compulsion.

On May 27th, China's Ministry of Finance issued the "Corporate Sustainable Disclosure Standards - Basic Standards (Draft for Comments)", officially initiating the construction of a unified national sustainable disclosure standard system.On July 18th, the "Communist Party of China Central Committee's 20th Third Plenary Session Communique" was published, which frequently mentioned accelerating the construction of top-level structures related to the ecological environment, such as systems and frameworks, and actively responding to climate change.

The regulatory guidance aligns significantly with the governance, strategy, risk, and opportunity management, as well as the "four elements framework" of metrics and targets in the International Sustainability Standards Board (ISSB) standards, which is beneficial for enterprises going global. It facilitates dialogue with the international market, helps overseas companies better understand and express, and is conducive to improving ratings.

In the future, the ESG disclosure requirements for Chinese companies will focus more on the integrity of the entire ESG management system, from top-level design, risk identification to specific measures, all of which will be disclosed, elevating the ESG disclosure requirements to a higher level.

Believing in the Future of ESG

This year marks the 20th anniversary of the United Nations Global Compact (UNGC) proposing the ESG concept. Although ESG is still exploring and advancing in some dimensions such as standardization and objective quantification, the trend of sustainable development as a paradigm shift in human economic operations will continue to be strengthened and promoted. From the above analysis, it can be seen that even with policy fluctuations from economic entities like the United States, other important economies are moving forward in ESG/climate governance regulation and practice. This is reflected in the regulatory demands for listed companies trending towards mandatory ESG disclosure, investment funds increasingly integrating ESG metrics, and rapid penetration of ESG management in the value chain.

Looking back at the criticisms of ESG by Trump, Vance, and Musk, it is not difficult to find that their arguments have many inconsistencies and are purely for the interests of a single party or individual, contradicting the development of human cognition.

For instance, the main reasons Tesla was once removed from the S&P 500 ESG Index include: reports of poor working conditions and racial discrimination at its Fremont factory, accidents involving its autopilot system, low ESG scores ranking in the bottom 25% globally, and issues with corporate governance and management. Electric vehicles should not receive high ESG ratings simply for using batteries. On the other hand, traditional energy companies like Exxon, with a clearer low-carbon development strategy, effective business conduct codes, better maintenance of labor conditions, and more effective management to reduce the environmental impact of their business, and stronger transparency and responsibility in corporate governance, there is nothing inconsistent about receiving high ESG ratings.

As for Trump and Vance's claim that ESG would sacrifice efficiency and affect the market's resource allocation mechanism, in fact, the rise of ESG and its acceptance by mainstream economies after 20 years of development is precisely because the world has recognized that the business model of maximizing shareholder interests by focusing solely on market efficiency has generated significant negative externalities for the environment and society, especially endangering the future fate of humanity in terms of climate change. Businesses can pursue multiple objectives, including maximizing shareholder interests while being responsible to the environment and society, which has become a more universally accepted value in contemporary times.

The change of political parties in the United States will not fundamentally affect the global trend of ESG development. From the perspective of Chinese enterprises, they should closely follow the guidance of domestic sustainable policies, integrate sustainable development into corporate strategy, business models, and operational management, and standardize ESG data management and disclosure to meet the ESG requirements of jurisdictions like the European Union and the main value chains of brands, in order to achieve greater market success with sustainable competitiveness.

Post a comment