Brokerage and investment banking business revenues continue to decline, with securities firms increasingly relying on proprietary trading. In the first half of this year, the proprietary business income of the 43 listed securities firms saw an increase in their proportion of total revenue.

According to the semi-annual report data, the 43 listed securities firms achieved a total proprietary business income of 74.972 billion yuan in the first half of the year, a year-on-year decrease of 8.66%, with the proportion of total revenue rising from 30.49% in the same period last year to 31.90%. Among them, more than half of the listed securities firms had a proprietary income ratio exceeding 30%.

In terms of performance, the proprietary income of various securities firms in the first half of the year was "uneven". Among the 43 securities firms, 27 saw a year-on-year decline in proprietary income, while 16 saw an increase or turned a loss into profit. Among them, 5 securities firms saw a year-on-year decline of more than 60%, and 4 securities firms saw a year-on-year increase of more than 60%.

Looking at the investment return rate, according to Wind data statistics, the average proprietary investment return rate of the securities industry fell from 2.5% in the same period last year to 2.2%, and the 43 listed securities firms fell from 3.27% in the same period last year to 2.65%.

CITIC Construction Investment's non-bank team analyzed in a recent research report that the withdrawal of investment business was mainly affected by the high base in 2023 and the dual pressures of equity market fluctuations in the first half of this year. In the first half of this year, several small and medium-sized securities firms achieved net profit growth, an important reason being that heavy asset departments represented by fixed income business achieved a year-on-year increase in securities investment income. Against the backdrop of significant market fluctuations in the first half of the year, some securities firms chose to increase their investment in the fixed income market, and the proportion and contribution of fixed income investment in proprietary business steadily increased.

A senior proprietary person from a securities firm told Yicai that it is not a good thing for securities firms, as intermediary institutions, to rely too much on heavy capital proprietary business for operating income. The higher the proportion of proprietary income, the worse the stability of the operating performance, the greater the impact of market fluctuations, and the weaker the risk resistance. In addition, the main source of the company's own funds is single, which is prone to liquidity risk.

Proprietary performance differentiation and decline in investment return rate

According to the semi-annual report for 2024, among the 43 listed securities firms, the differentiation of proprietary business income (net investment income + fair value change gains and losses - investment income from associated and joint venture enterprises) is obvious.

Looking at the top ten securities firms by proprietary income, the performance increase and decrease are evenly divided. Among them, the higher increase is Guangfa Securities, with a proprietary business income of 3.655 billion yuan in the first half of the year, a year-on-year increase of 43%. As of the end of June, the company's trading financial asset scale was 255.3 billion yuan, an increase of 39.2 billion yuan compared to the end of 2023.

The larger decline in performance is HuaTai Securities, with a proprietary business income of 4.214 billion yuan in the first half of the year, a year-on-year decline of about 28%. Both investment income and fair value changes have declined.The income differentiation of proprietary businesses among small and medium-sized brokers has become more pronounced. Hualian Securities' proprietary income has turned from negative to positive, while Dongxing Securities and Nanjing Securities have seen a significant year-on-year increase of over 100%. In contrast, several brokers, including Huaxi Securities, Pacific Securities, and Zhongtai Securities, have experienced a year-on-year decline of more than 60%.

In terms of investment return rates, according to Wind data statistics, there is a clear divergence among the investment return rates of the 43 listed brokers, with some small and medium-sized brokers experiencing significant fluctuations. Among them, 29 brokers saw a decline, and 14 brokers experienced an increase. Hualian Securities, which saw the most significant decline, saw its investment return rate drop from 9.2% in the same period last year to 3.11%; the largest increase was seen in Hongta Securities, whose investment return rate improved from 3.01% in the same period last year to 7.41%.

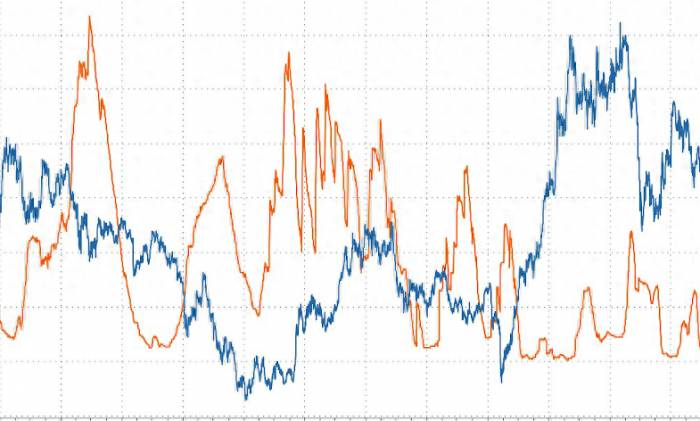

The above-mentioned senior proprietary personnel from the brokerage industry analyzed that the differentiation in proprietary performance is related to the asset allocation strategies of each broker. Affected by market conditions, brokers with a higher allocation of fixed-income assets or high-coupon equity assets in the first half of the year have relatively better proprietary business performance, while those with a higher allocation of equity assets are more affected by market fluctuations.

For example, Huaxi Securities disclosed in its annual report that the company's investment business operating income and operating profit decreased compared to the same period last year, mainly due to the impact of the A-share market conditions, with a reduction in equity investment business income and an increase in impairment.

The proportion of proprietary business revenue has increased

Overall, the 43 listed brokers achieved a total proprietary business income of 74.972 billion yuan in the first half of the year, a year-on-year decrease of 8.66%, with the proportion of revenue increasing from 30.49% in the same period last year to 31.90%. Compared to the 26.82% at the time of last year's annual report, the increase in proportion is even greater.

Compared to the same period last year, there are also many brokers whose proportion of proprietary income has increased, including leading brokers such as CITIC Securities, Guotai Junan, and China Galaxy, with a total of 23 brokers seeing an increase in the proportion of proprietary income compared to the same period last year.

Among them, more than half of the listed brokers have a proprietary income proportion exceeding 30%, with some brokers having a proportion of more than 50%. For example, China Merchants Securities and CICC's proprietary income accounted for 50% and 48% of their revenue in the first half of the year, respectively, while Tianfeng Securities, Great Wall Securities, Hongta Securities, and Shanxi Securities all had a proportion exceeding 50%, with Tianfeng Securities reaching 89%.

The increase in the proportion of proprietary income is not a recent phenomenon. In recent years, as competition in light capital businesses such as brokerage has become increasingly fierce, brokers have started to increase their proprietary investment efforts and weight. According to data from the China Securities Association, in 2023, the proportion of proprietary business in the revenue of the securities industry was 29.99%, in 2022, the proportion was 15.40% due to a significant withdrawal of proprietary income, and in 2021, the proportion was 27.48%.

According to calculations by the non-bank financial team of CITIC Construction Investment, among 107 brokers, 20 brokers have an average proportion of proprietary income exceeding 40% over the past five years. Among them, brokers with revenue between 2 billion and 50 billion or more than 20 billion have a higher dependency on proprietary business. "Due to the large income fluctuations and poor predictability of proprietary business, brokers with a high dependency on proprietary business generally have poorer performance stability," the non-bank financial team of CITIC Construction Investment mentioned in their research report.What risks does the increasing reliance on proprietary trading by securities firms pose?

As a capital-intensive business, the proprietary trading of securities firms, while supporting the growth of performance, also carries certain risks if there is an over-reliance on it.

In the view of the aforementioned senior proprietary trader, for securities firms, over-reliance on proprietary trading mainly has two issues. First, there is a significant fluctuation in performance. Whether it is equity proprietary trading or bond proprietary trading, the returns generated by investments depend on market trends. When the market fluctuates greatly, although it is possible to smooth investment returns through different accounting subjects to reduce the impact of market directional trends on investments, the actual impact on the performance of securities firms still exists, thereby affecting the operating conditions.

Second, there is liquidity risk. For proprietary trading, the main source of the company's own funds is single. The mainstream fixed-income business currently operates with high leverage. Once the market reverses quickly and the controlling shareholders cannot provide strong financial support, liquidity risk will be directly exposed.

"From a long-term development perspective, the proprietary trading of securities firms must develop differently, and regulatory authorities should implement classified management for the proprietary trading of securities firms. For institutions with strong shareholder capital strength and large net capital of securities firms, they can be relatively relaxed; for securities firms with weaker capital strength, the direction of proprietary trading should be guided towards transactional proprietary trading, to maximize the avoidance of risks and performance impacts brought about by high leverage and market fluctuations, thereby affecting the interests of listed company investors," said the senior proprietary trader.

A research report from CITIC Construction Investment's non-bank team analysis states that currently, many securities firms are focusing on high dividends, derivative hedging, and neutral strategies, and the transformation and deepening of investment business is underway. Traditional areas such as the brokerage business, investment banking business, and directional proprietary investment business of securities companies usually have obvious cyclical characteristics, and their revenue levels are closely related to the heat of the market. Proprietary investment oriented by capital intermediary business is taking root in the industry. Traditional long stock tends to look for high dividend and other configuration opportunities, and fixed-income business has contributed a large profit safety cushion for securities proprietary trading in the environment of the bond market continuing to stabilize. In addition, with the optimization of the calculation of the risk indicator system of securities firms, it further broadens the capital space of high-quality securities firms, improves capital efficiency, and is conducive to expanding the revenue space of securities firms' investment income, while promoting the implementation of comprehensive risk management requirements by securities companies.

Post a comment