Winning the Loser's Game

You try to hit a winning shot every time, but in reality, maintaining stability and consistency, adopting basic and reliable tactics, is enough to win the match in 90% of the cases. —— "Open: Andre Agassi Autobiography" (Andre Agassi, a superstar of the 1990s tennis world)

In 1970, Simon Ramo, an American physicist, scientist, and statistician, wrote a book on how to play tennis, titled "Extraordinary Tennis for the Ordinary Tennis Player."

As a guide written by a non-professional tennis player for the majority of ordinary players, Dr. Ramo made full use of his expertise—finding breakthroughs from data.

Ramo discovered through statistics that there are two ways to play tennis: one is the winner's game, where about 80% of the points come from excellent shots; the other is the loser's game, where about 80% of the points are lost due to "unforced errors" (mistakes made by oneself, unrelated to the opponent). To win cleverly, one must understand what kind of game they are playing.

Later, Charles Ellis, former chairman of the Yale University Investment Committee, introduced the concept of the winner's and loser's game into the investment field and named one of his books "Winning the Loser's Game: Timeless Strategies for Successful Investing," which is translated into Chinese as "Winning the Loser's Game: How Elite Investors Beat the Market."

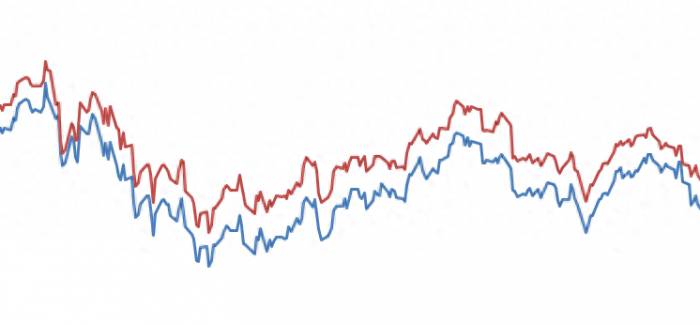

Charles mentioned in his book that with the development and changes of the times, the assumption that "investors can beat the market" has become extremely difficult. Even investors who have achieved this in the past find it increasingly hard to maintain or surpass their past glory. Investing is gradually shifting from a winner's game to a loser's game.

In other words, in a competitive, uncertain, and increasingly risky investment environment, only a very few investors can occasionally beat the market. Long-term success depends on understanding market efficiency, controlling risk, and avoiding frequent mistakes.

People like us strive to always avoid doing foolish things, rather than trying to be very smart, thus gaining a very significant long-term advantage. —— Charlie Munger

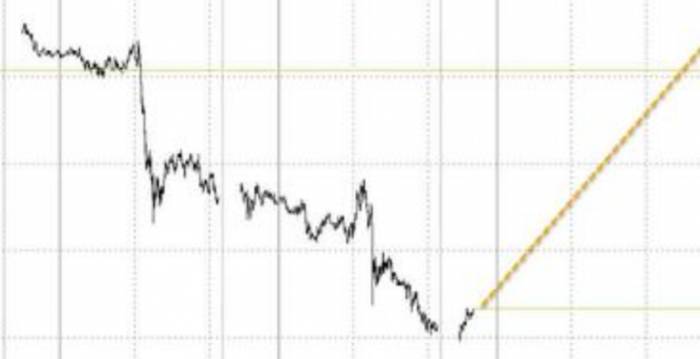

This can be understood through a set of simple data.A 10% decline requires approximately an 11.1% increase to break even;

A 20% decline requires a 25% increase;

A 50% decline requires a 100% increase;

An 80% decline necessitates a 400% increase!

Just imagine, when the market conditions are generally bleak, making frequent mistakes or a significant error can have catastrophic consequences. This is why Buffett would say that the first rule of investing is "don't lose money," and the second rule is "never forget the first rule."

When the market environment is favorable, it's as if everyone has been dealt good cards; to succeed, one must play better than others and win more. Conversely, when the market environment is harsh, everyone is holding bad cards, and only by doing the right things, making fewer mistakes, losing less, and staying at the table as long as possible, can one increase the chances of winning.

With your talent, if you only have 50% of the skill in the game but possess 90% of the wisdom in the match, you are destined to win; but if you have 90% of the skill in the game and only 50% of the wisdom in the match, your fate can only be to keep losing. —— "Open: Andre Agassi's Autobiography"

In most cases, mistakes in investing stem from investors' insufficient understanding of their own short-term emotions and long-term goals, as well as the external investment targets and market environment, or a lack of understanding of both.

Internal confusion leads to misjudgment, resulting in vague investor strategies, and making hasty decisions more likely when market conditions deteriorate and pressures mount, leading to wrong decisions at the wrong time for the wrong reasons.

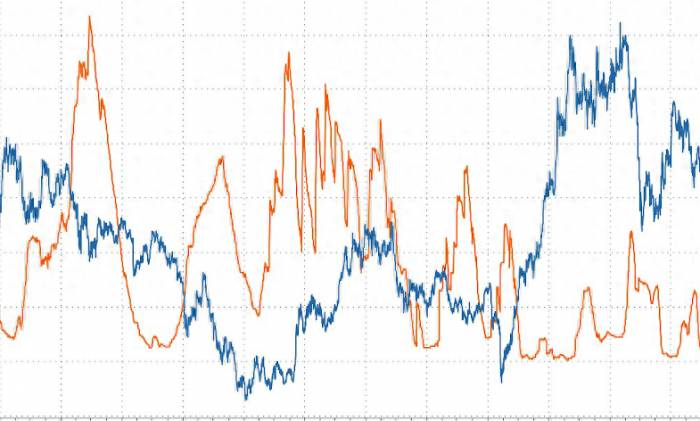

Despite knowing the reasons for mistakes, there is still a chasm between avoiding errors and doing the right things, with the biggest obstacle rooted in human nature—emotions.Market surges or plummets, along with the various public opinions that drive market fluctuations, can allow emotions to take the upper hand, thereby stimulating unrealistic expectations (or fantasies) and unnecessary panic (or anxiety).

At this time, the long-term goals of investment and what is truly important are often forgotten. Investors' resolve is eroded by the flood of emotions, plans are disrupted, and then mistakes are made.

Most of the time, advice on how to avoid the influence of emotions is like "hitting a ghost wall," such as adhering to long-termism, maintaining investment discipline, etc., but emotions, in turn, can undermine these suggestions. In the end, the problem is not truly resolved. Therefore, the root of emotional stampedes can be traced in past crises.

In fact, the reason why emotions bring risks is largely due to the loss of focus caused by behavioral disorder. The most direct way to control emotions is to keep a clear and calm mind, let reason return to the lead, and bring attention back to the real focus.

In this regard, tennis can provide some new ideas.

When professional tennis players make frequent mistakes or play abnormally, they are usually described as "not in the zone," which is actually a loss of focus. However, in top-level competitions, top tennis players are usually able to remain calm and focused under great pressure and perform well. This can also be seen in other sports competitions.

Concise, focused, time-saving, and effort-saving are the distinctive characteristics of great players, while others wander in the maze of details and lose their way to glory. —— Charles Ellis

So, what is the secret for these athletes to maintain focus?

The "sense of relaxation" at crucial moments: relaxed concentration

In my 29-year tennis career, I have understood one thing: on the road forward, life will throw all possible obstacles in front of you, and your duty is to avoid these obstacles. If you stop or get distracted by them, it is a dereliction of duty, and this will make you regret endlessly. This regret will make it harder for you to move forward than sadness. —— "Open: Andre Agassi's Autobiography"In 1974, tennis coach W. Timothy Gallwey published a groundbreaking book in the field of sports psychology titled "The Inner Game of Tennis: The ultimate guide to the mental side of peak performance." The Chinese version is "The Miraculous Power of Mind-Body Unity: The Psychological Secrets of Top Athletes in the Peak Duel."

On the surface, this is a guide to improving tennis skills, but in reality, it is also a manual on mental control and outstanding achievement.

Since its publication, the book has been widely praised, with more than a million copies printed, and its influence has extended beyond the field of tennis to many aspects of life.

Gallwey points out in the book that any game or competition consists of two levels: the external and the internal.

The external game includes the actual actions, strategies, and skills taken to achieve a certain result, that is, all the "methods" and "tactics."

The internal game is the game that takes place in the player's mind, aiming to combat psychological barriers such as lack of concentration, tension, self-doubt, and self-blame. In other words, the goal of the internal game is to overcome all psychological habits that hinder excellent performance.

Gallwey's core argument is that at the highest level of competition, success is not determined by technique or skill. Those who can stand on the peak of the field have mastered most of the technical details. What truly stands out and maintains excellent performance is the mastery of the internal game.

To more intuitively explain the mechanism of the internal game, Gallwey introduced the concept of "Self 1" and "Self 2."

Self 1 is the commander who gives orders, makes judgments, and tries to control behavior; Self 2 is the executor who instinctively and unimpededly performs actions. Whether the relationship between Self 1 and Self 2 is harmonious and unified determines whether the player can transform technique and knowledge into effective action.

The "judgment consciousness" in Self 1, that is, giving a positive or negative evaluation of a certain event, is one of the main reasons for emotional reactions and distraction. Judgment consciousness causes conflict between Self 1 and Self 2 and interferes with the execution of Self 2's actions.In tennis matches, a heightened sense of judgment can lead players into a vicious cycle of overthinking and behavior correction, which can subsequently affect the outcome of the game. In investing, an excessive sense of judgment, such as evaluations of market fluctuations, unexpected events, and news opinions, can trigger irrational emotional swings, leading to incorrect decisions.

If you do not understand yourself, you can find the answer in the stock market, but at a high cost. — George J.W. Goodman (American author)

Therefore, observing without judgment—focusing on the current reality, such as what exactly is happening, rather than emotionally interpreting it—is one of the secrets to maintaining inner calm and concentration.

Only in a state of calm concentration (which Gallwey calls "relaxed focus") can the two selves achieve harmony and unity, allowing the player to perform at their best.

This is equally important in investing.

Observation, as the primary step in the scientific method, determines the accuracy of theoretical construction, analysis, and hypotheses. Observing without judgment, especially at critical moments, can reduce emotional biases, maintain rationality and clarity of mind, and avoid mistakes as much as possible.

In modern society, one of the most indispensable skills for people is the ability to remain calm in the face of rapid and unsettling changes. In the face of pressure and risk, inner stability affects outer performance. To secure a place in fierce competition and turbulent times, it is crucial to cultivate the ability to see the essence of things and respond appropriately.

Successful investors, like top tennis players, are those who can see things as they are.

Investing is a long-term competition. First, one must familiarize themselves with the rules of the game, then learn the skills of the game, and on this basis, one must also possess the wisdom of the game.

Post a comment