Recently, Hainuoer Environmental Industry Co., Ltd. (hereinafter referred to as "Hainuoer") withdrew its IPO application, proactively ending this round of the IPO process.

From the acceptance on December 17, 2020, to the termination of the review, Hainuoer took as long as 1314 days (about three and a half years), making it the longest "holdout" among enterprises that have terminated the review under the registration system in the Shenzhen market. At the same time, this is also the third time Hainuoer has failed to make it to the Growth Enterprise Market (GEM).

Three attempts, three failures, and subject to regulatory on-site inspections.

Hainuoer mainly engages in urban domestic waste treatment business, using BOT, TOT, BOO, and other franchised operation methods to tailor comprehensive solutions for urban domestic waste treatment suitable for the characteristics of domestic small and medium-sized cities.

As early as 2012, Hainuoer began its first IPO application process, but it was rejected by the 24th meeting of the GEM review committee in 2012. According to the opinions given by the review committee at that time, it was believed that the company had been penalized by the environmental protection department many times for violating environmental protection laws and regulations, and its internal control system could not reasonably ensure the legality of its production and operation.

Seven years later, on June 28, 2019, Hainuoer sounded the charge again for the GEM, and in this application, Hainuoer elaborated on the improvement of environmental protection measures in a large amount of text.

However, this round of IPO only lasted for three months, and the application materials were withdrawn in September of that year. In December, the securities regulatory agency conducted an on-site inspection of Hainuoer and found many problems.

In April 2020, the China Securities Regulatory Commission (CSRC) announced its decision to take regulatory measures against Hainuoer by issuing a warning letter. Upon investigation, it was found that the company had some irregular accounting treatments for technical service fees related to the operation and management of some projects during the IPO application process, and failed to disclose the restrictions on currency funds truthfully.

More than a year later, in December 2020, Hainuoer made its third attempt at an IPO. After going through three rounds of inquiries, Hainuoer finally passed the meeting successfully in November 2021.

However, the GEM listing committee also paid attention to whether the company's internal control system was sound, including two construction projects of Hainuoer that occurred in December 2020 and July 2021, resulting in safety production accidents and casualties.However, Henor has not submitted for registration after the meeting and has not done so until it proactively withdrew its application.

The exchange has repeatedly questioned the industry-unusual gross margin rate.

Looking through Henor's three submissions, two major issues have always been pursued by the regulators: one is internal control, and the other is the gross margin rate.

The soundness of the internal control system of the company to be listed has always been one of the focuses of regulatory attention. From the multiple environmental penalties in the original rejection reason to the financial internal control issues found in the on-site inspection, all point out Henor's shortcomings. Therefore, in the third submission, the exchange's inquiries pointed to the internal control system. For example, the exchange asked the company to explain whether there were any irregularities in financial internal control during the reporting period, and also mentioned accounting treatments such as revenue recognition.

In addition, the gross margin rate, which is significantly higher than the industry, has caused significant questioning in Henor's three submissions, and the exchange has focused on the gross margin rate three times in three inquiries.

In the first time, it was required to explain the changes in the gross profit and gross margin rate of each project, analyze the differences and reasons; the second time, it was required to compare the gross margin rate by business and comparable companies, and explain the reason for the rapid increase in the gross margin rate of the waste treatment business; the third time, it was required to explain whether the cost advantage as an explanation for the higher gross margin rate than comparable companies is sufficient.

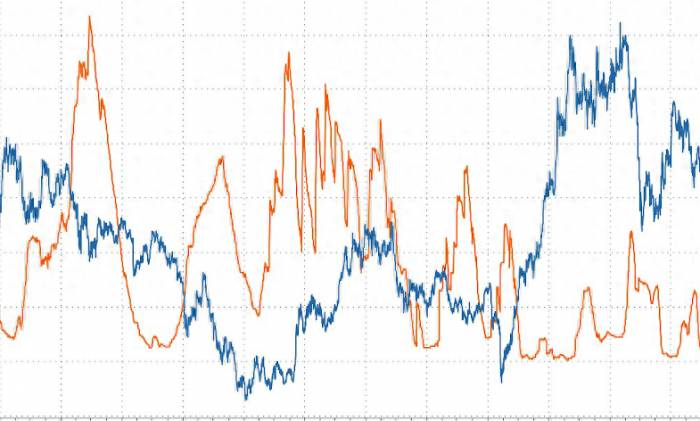

The prospectus shows that from 2018 to 2022, Henor's comprehensive gross margin rate was 48.32%, 48.71%, 61.33%, 61.11%, and 59.49%, while the average of comparable listed companies during the same period was 46.11%, 41.44%, 41.05%, 31.37%, and 32.15%.

It can be seen that after 2020, Henor's comprehensive gross margin rate is more than 20 percentage points higher than the average of comparable listed companies in the same industry.

Looking at the business, the gross margin rate of the power generation and online business is the highest, long-term above 60%; followed by waste treatment, which was around 40% from 2018 to 2019, and then began to increase sharply, exceeding 60% in the first half of 2021; while the gross margin rate of wastewater treatment is relatively low.

For such a large deviation, Henor said that the income structure of other comparable companies is more diversified, and some low gross margin projects have lowered the overall level. With the company's new waste incineration power generation projects gradually put into operation, the proportion of high gross profit incineration power generation projects in the main business gradually increased, coupled with factors such as improved operational efficiency, which has driven the continuous improvement of the main business gross margin rate.Additionally, regarding the higher gross margin in the waste-to-energy power generation business compared to the industry average, Hainuoer claims that part of the reason is that the waste-to-energy power generation projects are located in Sichuan and Guangxi, while most of the comparable companies' projects are located in the southeast coastal areas or the central core city of Changsha. Therefore, the issuer has certain cost advantages in terms of personnel, materials, and project operation and maintenance.

It has also been "collateral damage" on multiple occasions.

It is worth noting that after Hainuoer's successful review, it was stuck in the registration submission phase for nearly 2 years and 9 months, partly due to being implicated. The company's accounting firm is Xinyong Zhonghe Accounting Firm, and the asset appraisal institution is Zhongshui Zhiyuan Asset Appraisal Co., Ltd.

On January 26, 2022, due to the China Securities Regulatory Commission's (CSRC) investigation into Xinyong Zhonghe Accounting Firm, Hainuoer's review was suspended and resumed on February 23. After a six-month interval, on July 29, due to the CSRC's investigation into Zhongshui Zhiyuan Asset Appraisal, Hainuoer's review was suspended again and resumed on August 15.

Furthermore, Hainuoer's prospectus indicates that in July 2015, the company's sixth-largest shareholder, Liu Ruping, sold some shares to four external investors, including Shenwan Growth, Shanghai Junxing, Dingcheng Jiuding, and Suzhou Huikang, and signed a valuation adjustment mechanism (VAM) agreement. However, the terms of this VAM agreement are limited to the company's shareholders, but if the company ultimately fails to go public, there is still a risk that the VAM terms may be reinstated, and the company's shareholders may be required to fulfill the obligation to repurchase shares.

It is noteworthy that the general partner of Dingcheng Jiuding, Beijing Huitong Jiuding Investment Co., Ltd., and the general partner of Suzhou Huikang, Suzhou Kunwu Jiuding Investment Management Co., Ltd., are both wholly-owned subsidiaries of Kunwu Jiuding Investment Management Co., Ltd.

On July 23, 2021, Wu Gang, the actual controller of Jiuding Investment, was investigated by the CSRC for suspected violations of fund-related laws and regulations. By the end of 2022, the CSRC imposed a 5-year market entry ban on Wu Gang.

This investigation has far-reaching implications, with the IPOs of several "Jiuding series" invested companies once caught in a long wait, and some even failing. For example, Mao Ge Ping, which had passed the review in October 2021, has not yet received the registration approval and finally withdrew the application at the beginning of this year and turned to the Hong Kong stock market.

Post a comment