Starting from July 29th, the Shanghai Composite Total Return Index will change from publishing closing positions to publishing real-time market data, and will simultaneously adjust the index code and the index abbreviation to "000888" and "Shanghai Total Return," respectively.

The Shanghai Composite Total Return Index was officially launched on October 9, 2020, as a derivative index of the Shanghai Composite Index. Both indices have the same samples and weights, but the former includes sample dividends in the index returns based on the latter, reflecting the overall performance of Shanghai-listed companies after incorporating dividend income. The index uses July 21, 2020, as the base date, with a base point of 3320.89.

Several industry insiders told reporters from Yicai that the Shanghai Composite Index is a price index that does not reflect the dividend distribution of listed companies. When the index sample companies distribute dividends, the price index points naturally fall on the ex-dividend date along with the stock price. In contrast, the Shanghai Composite Total Return Index takes into account the reinvestment income of dividends, and the index points will not naturally fall. The two complement each other, jointly reflecting the overall performance of the stock prices and dividends of companies listed on the Shanghai Stock Exchange from multiple dimensions, providing investors with a richer set of market observation tools.

The Shanghai Stock Exchange stated that the next step will be to continuously enrich and improve the Shanghai broad-based index system, depict the overall performance of Shanghai companies from multiple dimensions, provide the market with a more diversified range of investment targets and reference tools, and support investment reform and the construction of a multi-level capital market.

Shanghai Total Return complements the Shanghai Composite Index

On July 15th, when the news of the Shanghai Composite Total Return Index officially launching real-time market data was released, some market participants mistakenly believed that this was a new index that would replace the Shanghai Composite Index.

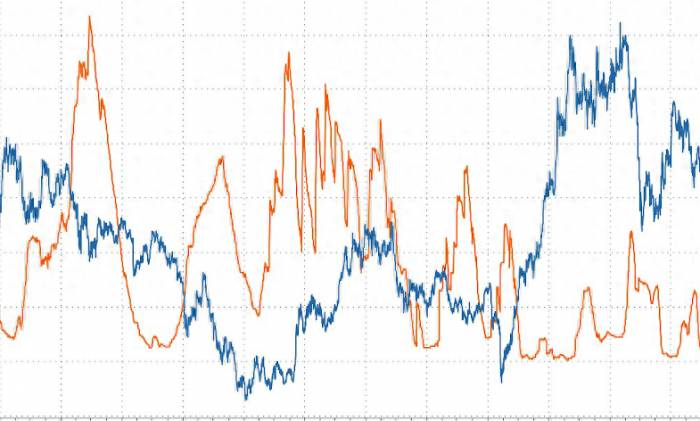

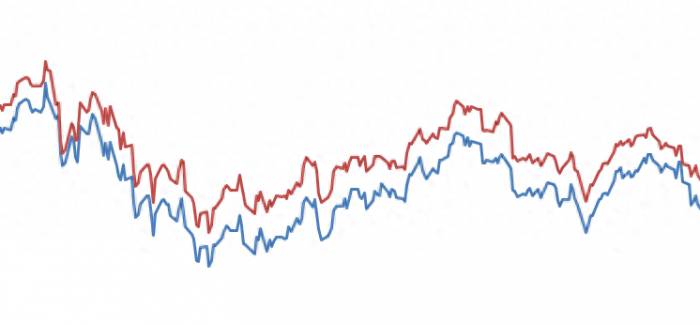

In fact, the Shanghai Composite Total Return Index was launched in October 2020, reflecting the overall performance of the stock prices and dividends of companies listed on the Shanghai Stock Exchange. From the base date (July 21, 2020) to the end of June 2024, the cumulative returns of the Shanghai Composite Total Return Index were 8.2% higher than the price index, with an annualized return 2.2% higher than the price index.

The Shanghai Composite Total Return Index is a derivative index of the Shanghai Composite Index. The Shanghai Composite Index, which was published on July 15, 1991, is the first stock index in the A-share market and is also the most important reference indicator for investing in A-shares. The current official abbreviation is "Shanghai Composite Index," also known as "Shanghai Composite Index" or "Shanghai Index," with the index code 000001.

The well-known Shanghai Composite Index is a price index that reflects the overall market value changes of Shanghai-listed companies based on current transaction prices. Since the dividends of listed companies have been distributed to shareholders in cash and deducted from the market value, the price index does not reflect the cash dividends of the samples, only reflecting the price performance of the index samples.

When the index samples distribute dividends, the Shanghai Composite Index, as a price index, will naturally fall on the ex-dividend date, while the Shanghai Composite Total Return Index takes into account the reinvestment income of dividends, and the index points will not naturally fall. Therefore, from the base date of the Shanghai Composite Total Return Index (July 21, 2020) to the end of June 2024, the index points are 277 points higher than the Shanghai Composite Index.That is to say, the "Shanghai Stock Exchange (SSE) Income" is the total return index of the "Shanghai Stock Index," which aims to reflect the overall stock price performance of listed companies in the Shanghai market. The "SSE Income" comprehensively reflects the overall performance of stock prices and dividends of listed companies in the Shanghai market. Qian Jun, the Executive Dean of the International Finance College at Fudan University, analyzed that according to the compilation rules, when the dividend of the constituent stocks is deducted, the dividend income is not included in the SSE Composite Index, and the index naturally falls back. However, at this time, investors have already obtained "real gold and silver" dividend income, and there is a difference between the index point fluctuation and the actual income of investors. Moreover, as the dividends of listed companies in the Shanghai market continue to increase, the difference between the two is further expanded. Compared with the SSE Composite Index, the SSE Comprehensive Total Return Index includes the dividend of the constituent stocks in the index income, which is an important supplement to fully represent the overall market income situation. It can comprehensively reflect the performance of the index sample price and cash dividends, providing more dimensions to observe the market.

Internationally, when index compilation organizations publish price indexes, they generally also publish the corresponding total return indexes, such as the S&P 500 Total Return Index, to allow investors to observe the market from more dimensions.

Yao Ya Wei, the Vice Dean of the Business School at Shanghai Normal University, said that from the experience of foreign markets, some major indexes of the market adopt the compilation method that includes dividend income. Taking the typical blue-chip stock market in Germany, the DAX index, as an example, due to the high dividend listed companies such as BMW and Bayer in the constituent stocks, it also has the characteristics of high dividend rates. The compilation of this index is the same as the SSE Comprehensive Total Return Index, which includes dividend income.

Why does SSE Income switch to real-time publication at this time?

So, why is the SSE Comprehensive Total Return Index changed from publishing closing positions to real-time publication at this time?

In this regard, some institutional people said that on the 33rd anniversary of the publication of the SSE Composite Index, the launch of the total return index calculated in real-time is an important measure for the Shanghai Stock Exchange to improve the index compilation method and improve the "Shanghai Index" system, which helps investors to observe the overall performance of the Shanghai securities market and the comprehensive return of dividend investment income more timely, conveniently, and comprehensively.

Stock dividends are an important part of stock income and are one of the important indicators to reflect the stability of the listed company's operation. In recent years, the total dividend amount and proportion of the Shanghai market have continued to increase, and cash dividends have become an important way for the A-share market to return to investors.

In the past 10 years, the cumulative dividend of listed companies in the Shanghai market has reached 11.2 trillion yuan, accounting for nearly 80% of the entire A-share market. The annual dividend scale has increased from 682.9 billion yuan to 1.73 trillion yuan. The dividend rate has also shown a steady upward trend. Before 2012, the median dividend rate of the SSE Composite Index constituent stocks was about 1%. Since 2013, this median has risen to about 2.2%. At present, the average dividend rate of the SSE Composite Index has reached 2.8%, higher than the 2.2% of the entire market.

Among them, the total cash dividend of listed companies in the Shanghai market in 2023 exceeded 1.7 trillion yuan, which is more than twice the total dividend in 2011, with an average annual growth rate of 10.5%. As of the end of June 2024, the rolling 12-month dividend rate of the Shanghai market has reached 2.8%, a significant increase from 1.7% at the end of 2011.With the improvement of the dividend payout level in the Shanghai stock market, the excess return of the Shanghai Composite Total Return Index over the price index has continued to expand. Since the base date of July 21, 2020, up to July 15, 2024, the Shanghai Composite Total Return Index has led the Shanghai Composite Index by 297.49 points, with a cumulative increase of 8.96%.

"In recent years, an increasing number of listed companies have been rewarding investors through dividends, and high dividends have become an important characteristic of the Shanghai market. The dividend yield of the Shanghai Composite Index has reached 2.8%. Compared to the compilation method of the Shanghai Composite Index, the Shanghai Composite Total Return Index takes into account the dividend returns of listed companies, which can more comprehensively and accurately reflect the actual return situation of investors investing in Shanghai stocks," said Zhang Zongxin, a professor of finance at the Institute of Finance at Fudan University.

In the view of the aforementioned institutional personnel, the real-time release of the Shanghai Composite Total Return Index will further guide investors to focus on high-dividend quality listed companies in the Shanghai market. At the same time, it will promote listed companies to further enhance their sense of social responsibility and shareholder awareness, and continuously promote a rational investment, value investment, and long-term investment atmosphere throughout the market.

Post a comment