By the end of July, two major automotive component giants, Contemporary Amperex Technology Co., Limited (300750.SZ) and Fuyao Glass (600660.SH), successively released their 2024 semi-annual reports with double-digit profit growth rates.

In the first half of the year, where the price war among complete vehicles intensified, what kind of magic weapon did Zeng Yuqun and Cao Dewang have in their hands to allow their companies to maintain growth amidst industry challenges?

"Earnings come from the competitive landscape," some industry insiders believe that the products of Contemporary Amperex Technology and Fuyao Glass hold more than 30% of the global market share, and they have strong pricing power over upstream and downstream. Especially for downstream automotive companies, they don't have many other options when it comes to purchasing core components, which is different from other component enterprises with low market concentration that are forced to follow the significant price reductions of vehicle manufacturers.

Double-digit profit growth

The decline in upstream lithium carbonate prices and the downstream vehicle price war led to losses for related companies in the first half of the year, while Contemporary Amperex Technology's profits were on the rise. How did they achieve this?

On the evening of July 26, Contemporary Amperex Technology released its 2024 semi-annual report, achieving a total operating income of 166.767 billion yuan in the first half of the year, a year-on-year decrease of 11.88%; net profit attributable to shareholders of the listed company was 22.865 billion yuan, a year-on-year increase of 10.37%; basic earnings per share were 5.20 yuan. In terms of profitability, Contemporary Amperex Technology's gross margin reached 26.53%, an increase of 4.9 percentage points compared to the 21.63% gross margin in the first half of 2023.

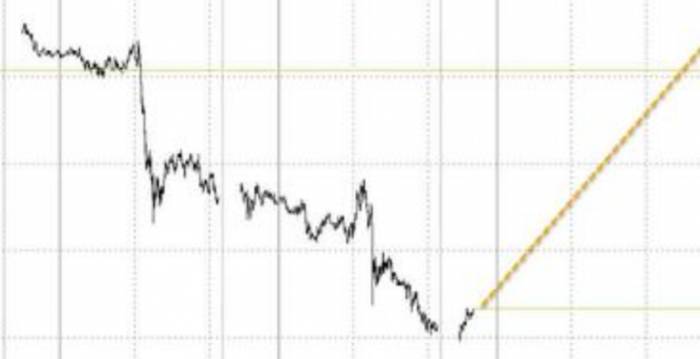

Contemporary Amperex Technology stated in its 2023 annual report that the main raw materials required for the company's production and operation include cathode materials, anode materials, separators, and electrolytes, etc. The prices of the aforementioned raw materials are greatly affected by the prices of commodities or chemical raw materials such as lithium, nickel, and cobalt. Influenced by the changes in the prices of related materials and market supply and demand, the purchase prices and scale of the company's raw materials will also fluctuate to a certain extent. The significant rise and subsequent fall in raw material prices, represented by lithium carbonate, have caused considerable cost fluctuations.

A person in charge of Contemporary Amperex Technology said on the evening of July 26 at the performance briefing meeting that the company's production and order schedule for the second half of the year is full, and the utilization rate of production capacity is expected to be further improved. There are often rumors about the company's production schedule on the market, most of which are inaccurate. The Shenxing and Qilin batteries began to be mass-produced this year, and looking at the whole year, Shenxing and Qilin batteries account for 30 to 40% of the company's power battery shipments. Currently, many projects are still being promoted, and the shipment proportion of the above two types of batteries will continue to increase in the future.

Compared with Contemporary Amperex Technology's revenue decline and profit increase, Fuyao Glass has achieved revenue and profit growth rates of over 20%.

"As a leading enterprise in the automotive glass industry, both volume and price are rising, and the siphon effect continues to strengthen, further enhancing profitability." On the evening of July 30, Fuyao Glass's semi-annual performance report showed that in the first half of 2024, the company's consolidated operating income was 18.34 billion yuan, a year-on-year increase of 22.01%, higher than the industry growth level; the total profit was 4.125 billion yuan, a year-on-year increase of 24.26%. If the impact of exchange gains and losses and the termination of the performance of the remaining 24% equity transfer of Beijing Futong by Taiyuan Jinnuo Industrial Co., Ltd., reducing investment income, is excluded, the total profit increased by 59.95% compared to the same period last year.On July 28th, Fuyao Glass announced that its wholly-owned subsidiary, Fuyao America, located in Moraine, Ohio, accepted an on-site search by U.S. government agencies around 10 a.m. local time on July 26th. Fuyao America was primarily cooperating with the U.S. government's ongoing investigation into a third-party labor service company. According to the U.S. government agencies, Fuyao America was not the target of the investigation. Around 5 p.m. the same day, after completing their on-site work, the U.S. government agencies left. The announcement stated that during the aforementioned search, some production operations at Fuyao America were temporarily suspended on that day, but cargo transportation and delivery were not affected. After the search, normal operations resumed on the same day, and currently, all production and business operations are normal.

A Hong Kong analyst told reporters from Yicai that compared to traditional fuel vehicles, most electric vehicles have sunroofs, and fuel vehicles are increasingly adding sunroof configurations, which significantly increase the average glass application area per vehicle. This is a boost for glass companies. Therefore, although the car market is not ideal, with the increasing penetration rate of electric vehicles, the amount of glass used is still increasing.

Market share creates bargaining power.

Some industry insiders believe that component companies with main customers as domestic brands are continuously breaking through the upper limit of operating income, but the payment cycle of customers is getting longer and longer, and the "big knife" of cost reduction has to be wielded overhead every quarter; component companies with main customers as joint ventures are in a difficult situation, facing the shrinkage of orders and the pressure of cost reduction at the same time.

However, CATL and Fuyao Glass are not among the aforementioned troubled component companies, and the key may lie in their bargaining power with upstream and downstream, as well as a global market share of over 30%. Large production volumes can significantly reduce unit costs, forming a deep "moat" for these giants.

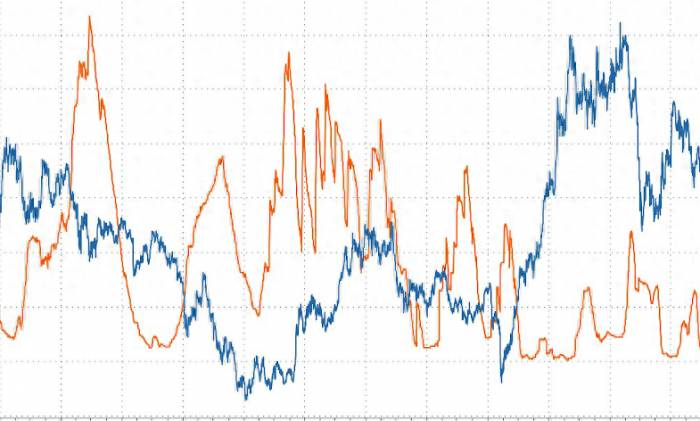

CATL's semi-annual report shows that in terms of industry status, the company is a world-leading power battery and energy storage battery enterprise. In the field of power batteries, according to data from SNE Research, the company has ranked first in the global power battery usage for seven consecutive years from 2017 to 2023. From January to May 2024, the company's power battery usage global market share was 37.5%, an increase of 2.3 percentage points from the same period last year, still ranking first in the world.

Huafu Securities analyst Deng Wei said that in the first half of the year, CATL's domestic power battery share reached 46.4%, a year-on-year increase of 3 percentage points. Among them, the share of ternary power batteries reached 68.0%, a year-on-year increase of 6.4 percentage points, and the share of lithium iron phosphate power batteries reached 37.2%, a year-on-year increase of 2.1 percentage points. The Shenxing battery and Qilin battery began to be mass-produced this year, and the proportion of annual shipments is expected to reach 30% to 40% and continue to increase. Overseas, the German factory is still in the process of capacity climbing, with the goal of achieving a break-even for the year, and the Hungarian factory has completed the capping of some plant buildings and equipment debugging. The company's orders for the second half of the year are full, and the utilization rate of production capacity is expected to be further improved.

Xuanjia Fund General Manager Lin Jiayi told Yicai reporters that CATL's pricing system has reached a relatively stable structure with car manufacturers. CATL can reduce prices, but car manufacturers need to cooperate with larger procurement volumes. At present, the competitive pattern of the car market determines that it is difficult for a single car manufacturer to achieve a particularly large volume.

"In fact, the money CATL makes is the money of the competitive pattern," Lin Jiayi said. The competitive pattern of upstream lithium battery materials is not as good as that of batteries, and the competitive pattern of downstream cars is not as good as that of batteries. The industry has confirmed CATL's pricing status of products in the upstream and downstream of the industry chain. At this point in time, if car manufacturers want to make batteries, they must be able to make them, maintain technological foresight, and also need capital investment, but the scale must not be able to be larger than that of such third-party full-market companies.

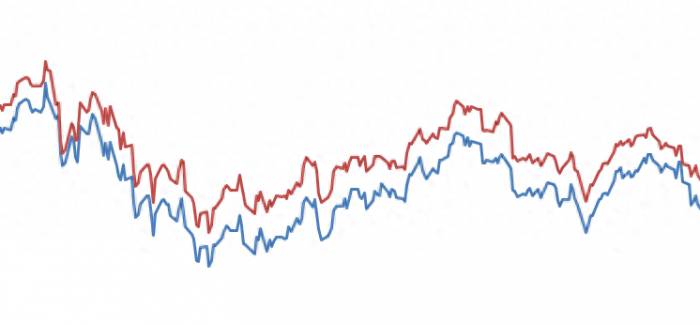

Regarding Fuyao Glass's market share, Dongwu Securities analyst Huang Xi said that the revenue of the automotive glass business has maintained a stable growth, increasing from 938 million yuan in 2001 to 29.887 billion yuan in 2023, with a compound annual growth rate of 16%. In terms of global share, Fuyao is also the only player among the world's major automotive glass companies that has maintained a stable increase in market share, with the global share increasing from 2.6% in 2001 to 30.1% in 2023. In terms of profitability, Fuyao has also maintained at a high level, with the operating profit margin basically maintained at around 20%, far ahead of competitors. In terms of business expansion, Fuyao Glass's capital expenditure is currently at a high level, and the company is entering the third round of capital expenditure cycle, with high enthusiasm for expansion.Huang Xili believes that, looking at the global automotive glass market, the main competitors of Fuyao (Asahi Glass, Saint-Gobain, and Nippon Sheet Glass, etc.) are in a state of low expansion willingness for their automotive glass business. In terms of business scale, the automotive glass business revenue of the three main competitors has been long-term stable at a certain scale, with a low compound growth rate. In terms of market share, the global share of the three main competitors has basically been stable at a certain level, and there has been no significant increase in recent years. In terms of profitability, the operating profit margins of the automotive glass business of the two Japanese companies are at a relatively low level and have fluctuated significantly in recent years. Saint-Gobain's profitability is better than the two Japanese companies but still has a significant gap compared to Fuyao.

Post a comment