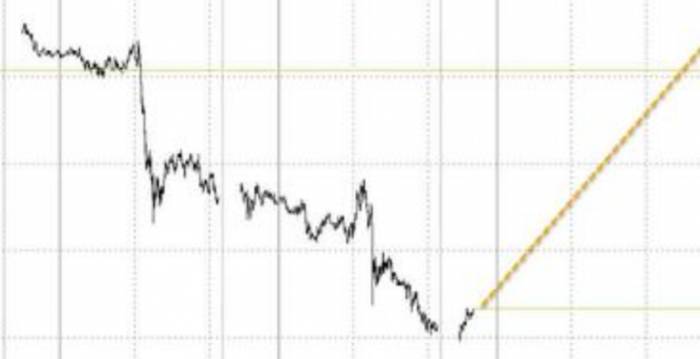

This year, the banking sector, which has been on a continuous upward trajectory, experienced a significant correction this week, with the CSI Banking Index (399986) falling by more than 3%.

Industry insiders believe that under the influence of "Central Bank Week," the LPR (Loan Prime Rate) and deposit rates have been reduced, leading to changes in capital's expectations for the quality of bank assets. This has caused fluctuations in bank stocks this week, attracting the attention of many investors. In the view of these professionals, the short-term volatility in bank stocks is due to a shift in capital styles, and in the future, driven by dividend strategies, the "silver content" of capital is expected to increase.

Bank stocks fluctuated and declined

The central bank's OMO (Open Market Operations), LPR, and MLF (Medium-term Lending Facility) have successively cut interest rates, and state-owned and joint-stock banks have quickly followed suit by adjusting their deposit rates symmetrically. Since the beginning of this week, the reduction in various market interest rates has caused fluctuations in the performance of bank stocks.

On July 22, the banking sector fell collectively, and then the stock prices rebounded, with stocks of ICBC, BOC, ABC, and BOCOM reaching new highs. Subsequently, bank stocks fell again, with consecutive declines on July 25 and July 26. The CSI Banking Index closed lower for three trading days and higher for two trading days within the week, with a cumulative decline of 3.11%, marking the highest weekly drop of the year.

In terms of individual stocks, almost all 42 listed bank stocks were affected, with only ICBC and Bank of Hangzhou recording gains. Among the declining stocks, Minsheng Bank fell by 6.86%, the largest decline among bank stocks. This stock was sold at a discount in 18 block trades on July 24. Bank of Beijing fell by 6.04% over the week, while China Merchants Bank, Huaxia Bank, and CITIC Bank all fell by more than 5%.

A public fund manager in Shanghai analyzed for the reporter that the bank sector's fluctuating trend this week was influenced by the news of multiple market interest rate cuts, leading to changes in capital's expectations for the quality of bank assets. Specifically, it was due to a change in style by passive funds and Northbound capital that had entered the market earlier.

Wind data shows that Northbound capital has been net selling bank stocks for three consecutive days since last Wednesday, with net sales of 243 million yuan, 1.651 billion yuan, and 1.102 billion yuan, respectively. The total net sales of bank stocks for the week reached 1.329 billion yuan, with more than half of the stocks being net sold by Northbound capital. Among them, China Merchants Bank was net sold by a total of 501 million yuan.

"Northbound capital is driving the rise and fall of bank stocks in the short term, but the style switch is quite fast," said Dai Zhifeng, Chief Analyst of the Banking Industry at Zhongtai Securities. Insurance and bank wealth management are the foundation of bank stocks, and active funds will significantly increase their positions only when the trend is determined. Overall, since 2020 to the present, high-quality joint-stock banks and large banks have received more inflows of Northbound capital.

The aforementioned person further stated that capital had previously purchased a large amount of broad-based index ETFs represented by the CSI 300 Index, which boosted the rise of bank stocks. However, with the change in capital style in the third quarter, ETF funds experienced a significant adjustment last week, causing a certain drawdown effect on the banking sector. Nevertheless, overall, the market remains optimistic about the improvement in the quality of bank stock assets.Zhejiang Securities' Chief Analyst of the Banking Industry, Liang Fengjie, pointed out that the current round of deposit rate cuts can offset the impact of the previous LPR adjustments, stabilizing the cost of liabilities. After the LPR adjustment on the asset side, the transmission speed to the liability side interest rates has significantly accelerated, supporting the bank's net interest margin.

The central bank's "combination punch" of interest rate cuts initially put pressure on bank stocks within the week, but as major banks followed suit by lowering their posted deposit rates, bank stocks gradually rebounded, with many declining bank stocks receiving reverse inflows of funds. For instance, Minsheng Bank saw a cumulative decline of 6.86% for the week but received a net purchase of 530 million yuan from Northbound capital. Chongqing Bank and Changshu Bank experienced不同程度的下跌, both receiving net purchases from Northbound capital exceeding 100 million yuan.

The "silver content" is still expected to increase.

The significant fluctuations in bank stocks within the week have caused concern among investors, leading to doubts about whether the third-quarter dividend strategy for bank stocks has reached its end. A financial market department insider told reporters that, thanks to the dividend strategy implemented in the first half of the year, many institutions have already achieved their annual investment targets and are adjusting their investment styles in the third quarter. Recently, they have been reducing holdings in bank stocks and other "dividend stocks" to secure profits, and this reduction may continue for some time.

Some industry insiders also pointed out that although the trend of public mutual funds increasing their allocation to bank stocks has been evident this year, the current allocation of public mutual funds to bank stocks is still at a low level, and the "silver content" is expected to increase further. "Institutional holdings of bank stocks are slowly recovering, and there is still room for optimism in terms of increased allocation," said Xiao Feifei from CITIC Securities. At the end of the second quarter, bank stocks accounted for 2.45% of the heavy positions of active funds, a slight increase from the end of the first quarter, but this holding ratio is still relatively low historically.

Wind data shows that, as of the end of the second quarter, the total market value of bank stocks held by all funds accounted for 4.98% of the total heavy positions of funds. State-owned banks, joint-stock banks, city commercial banks, and rural commercial banks accounted for 0.77%, 0.59%, 0.92%, and 0.17% of the heavy positions of active funds, respectively, with state-owned large banks seeing the largest increase in holding ratios.

Dai Zhifeng pointed out that passive funds have been an important force driving the rise of bank stocks this year. The scale of passive funds has grown rapidly this year, reaching 90% of last year's annual increase in the first five months. As the sector with the largest weight in the CSI 300 Index, bank stocks have benefited from the rapid growth of broad-based indices represented by the CSI 300, and the impact of passive funds on banks is expected to further increase in the future.

Fan Jituo, Chief Analyst of Cinda Securities Strategy, pointed out in a report that the proportion of fund holdings in the dividend sector continued to increase in the second quarter. Although it shows an overall underweight pattern, it is expanding. He believes that the stable high dividend yield and low valuation still attract capital. Moreover, as the influence of passive equity funds gradually increases, the demand for allocation to the dividend sector may rise, potentially reversing the long-term underweight status of active equity funds in the dividend sector.

A securities proprietary person also analyzed for the reporter that banks, as an important part of the broad-based index, are expected to benefit from the growth of passive fund scale. If the economic growth slows down in the future and the market conditions are relatively weak, the scale of index funds may further expand, bringing more incremental funds to the bank sector.

Post a comment