On Wednesday, the "Federal Reserve's favorite employment indicator" collapsed, with the JOLTS job openings unexpectedly weakening to the lowest level since early 2021. Evidence of a weak labor market has strengthened the market's expectations for a significant rate cut by the Federal Reserve, also causing U.S. Treasury yields to plummet. The 10-year benchmark bond yield, known as the "anchor of asset pricing," fell as much as 7.5 basis points to 3.768%.

However, there are currently traders betting that tonight's non-farm employment report will be very strong, potentially pushing U.S. Treasury yields up significantly by 25 basis points, breaking through the key threshold of 4%.

Analysis suggests that, driven by the political need to demonstrate a "strong economy" before the elections, the U.S. Bureau of Labor Statistics might "adjust the data" to create an illusion of a robust labor market. On Wednesday, the demand for put options on 10-year Treasury bonds increased significantly, with some investors betting that U.S. Treasury yields will rise to 4.05% by Friday.

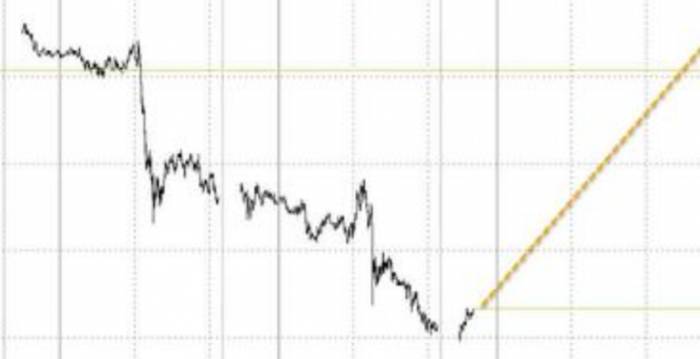

Significant increase in put options, with traders betting on a surge in U.S. Treasury yields.

On September 5th, the well-known financial blog ZeroHedge published an article stating that despite the poor performance of the JOLTS employment report, the market seems to have misjudged its importance, erroneously equating a lagging employment report with the upcoming latest data. The JOLTS report is typically one month behind the non-farm employment data, and with recent frequent revisions of data, the Bureau of Labor Statistics may once again adjust the data to create an illusion of a "stronger labor market." Regardless, the Federal Reserve may cut rates by 25 basis points in September to meet the political need to demonstrate a "strong economy" two months before the election.

Last week, ZeroHedge predicted on social media platforms:

Anyone expecting a weak (non-farm) employment report next week will be very disappointed: this is why there were downward revisions before. Now, the Bureau of Labor Statistics (BLS) will continue to make the economy look "as strong as possible" two months before the election through data manipulation or target adjustments.

It stated that once the employment data announced on Friday is "hot," the market will immediately reverse the "economic hard landing" expectations it has adopted in the past few days, causing U.S. Treasury yields to soar rapidly. ZeroHedge added that the August non-farm payrolls may reach 200,000, higher than the market's general expectation of 165,000, and also higher than July's 114,000. Expectations of an economic hard landing have once pushed the possibility of a 50 basis point rate cut in September to 50%.

The market seems to have a consensus on this. Edward Bolingbroke, a short-term interest rate expert at Bloomberg, pointed out that on Wednesday morning, the demand for put options on 10-year Treasury bonds increased significantly, with some investors betting that U.S. Treasury yields will rise to 4.05% by Friday. Traders have invested millions of dollars, betting that U.S. Treasury yields will surge within the next 48 hours.

The main risk event in the options market this time is Friday's non-farm employment report. In other words, some are betting that the report will be strong, thereby pushing the 10-year U.S. Treasury yield to rise significantly by 25 basis points.Despite the majority of investment banks still maintaining a "dove" stance, some sell-side institutions anticipate a massive long position closing following the release of the employment report. Citigroup strategists had previously recommended a short position in 10-year U.S. Treasury bonds, arguing that if the employment data meets expectations, interest rates will rise because "there is no significant deterioration in the labor market."

ZeroHedge suggests that, whether to address political demands for the election or as a result of capital flows, at least one trader has bet millions of dollars that the non-farm employment data will drive a surge in U.S. Treasury yields.

The 10-year U.S. Treasury yield is still hovering at a two-week low.

Data released on Wednesday showed that the U.S. JOLTS job openings in July were 7.673 million, falling to the lowest level since early 2021, significantly below the expected 8.1 million, and the previous figure was revised down from 8.184 million to 7.91 million. Citigroup stated that if Friday's non-farm employment report confirms that the labor market is deteriorating, it expects the Federal Reserve to cut interest rates by 50 basis points in September and again by 50 basis points in November.

After the release of the U.S. JOLTS data, the 10-year benchmark bond yield fell the most by 7.5 basis points to 3.768%, the lowest since August 21. Currently, the yield on the 10-year U.S. Treasury note remains at a two-week low, at 3.769%.

Leave a Reply