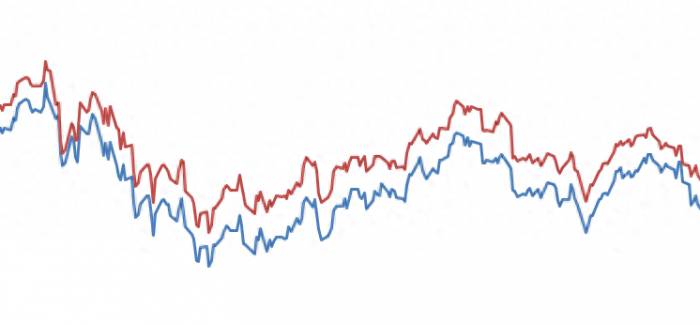

In September, the global stock market started on a bleak note, with the three major U.S. stock indices encountering a black Tuesday, marking the largest single-day drop since August 6th. The Nasdaq fell by over 3%, and the S&P fell by 2%. The fear index VIX rose to 20%. The market still hadn't stabilized by Wednesday, and the Asian market was also affected.

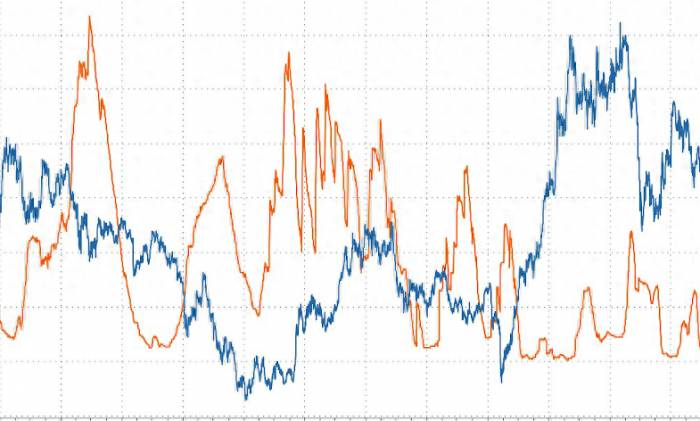

More worryingly, the combination that triggered the global plunge in August has re-emerged recently— a significant drop in U.S. stocks and an appreciation of the yen. The hawkish shift by the Bank of Japan in early August once caused the yen to surge nearly 10% against the dollar, and the liquidation of carry trades further impacted global stock markets. The appreciation of the yen, which has always had a safe-haven attribute, is itself a manifestation of market risk aversion. The recent appreciation of the yen has led to another significant drop in the Japanese stock market, with nearly 4% and 1% drops on Wednesday and Thursday, respectively. The Asia-Pacific stock market is under pressure, with the Shanghai Composite Index breaking through the 2,800-point threshold this week, and the Hang Seng Index in Hong Kong breaking through the 17,500-point threshold.

FXTM's Chief Analyst, Yang Ao, told reporters from Yicai that September is not friendly to U.S. stocks. Most months of the year provide positive returns for the world's major stock indices, but September is the only one with a negative number. This is mainly because September is a period of earnings vacuum, lacking good news, and important interest rate meetings are often concentrated in September. Additionally, September to October is the off-season for U.S. retail consumption, and the market has to wait until Thanksgiving and Christmas to usher in a consumption peak. However, he believes that there is currently no need to worry about a repeat of the August sell-off. Although the continued appreciation of the yen and the weakening of the dollar are the general trend, carry trades have already been largely liquidated, and the probability of the U.S. lowering interest rates under the background of an economic "soft landing" is increasing, which is also beneficial to the U.S. and Asian stock markets.

The market started September on a bleak note. This week, poor U.S. economic data, coupled with the Bank of Japan's continued interest rate hike stance, reminded the market of the turbulent market conditions at the beginning of August.

At that time, poor U.S. non-farm employment data in July, with the unemployment rate soaring to 4.3%, triggered concerns about a recession. Coincidentally, the yen surged due to the hawkish interest rate hike by the Bank of Japan, leading to a reversal of funds that financed yen at low interest rates to invest in high-interest assets overseas, exacerbating the market's decline.

Now, the same formula seems to be re-emerging. The latest data shows that the U.S. August ISM manufacturing PMI rose from 46.8 to 47.2, which has been below the boom-or-bust line for five consecutive months, and has been below 50 for 21 out of the past 22 months. The above data has once again increased expectations of a recession. The three major U.S. stock indices encountered a black September, marking the largest single-day drop since August 6th, with the Nasdaq falling by more than 3%. Nvidia plummeted by nearly 10%, with a single-day market value evaporation of $279.8 billion, setting a record for the U.S. stock market, and dragging down a group of semiconductor and technology stocks. To make matters worse, after the market closed, the U.S. Department of Justice issued subpoenas to some companies, including Nvidia, seeking evidence of antitrust violations, signaling that U.S. regulation of Nvidia and the AI field is intensifying. In addition to U.S. stocks, major global indices were not spared on Tuesday.

At the same time, the Governor of the Bank of Japan reiterated in a government document that if economic and price data meet expectations, the central bank will continue to raise interest rates. "We expect that the Bank of Japan will most likely continue to raise interest rates in October, and it is expected to continue to raise interest rates once next year. In the future, it is also necessary to observe whether Japan's wage growth can continue to rise. The wage growth rate announced in July turned positive for the first time, and in the short term, it is not ruled out that the dollar/yen will impact the 140 mark. Once it breaks through, it may impact the 135 mark," said Yang Ao.

StoneX's senior strategist, David Scutt, told reporters that September is not a market-friendly month. This is the month when the average returns of the three major U.S. indices, the Australian ASX 200, the German DAX, the Hang Seng Index in Hong Kong, and the CSI 300 are all negative. The average return rate of the S&P 500 index in September is negative (-1.1%), with a win rate of only 44.2%, which means it closes down 55.8% of the time. Data shows that the S&P 500 index has closed down in 4 out of the past 4 Septembers and 7 out of the past 10 years.

Non-farm data is under scrutiny.In this context, the U.S. non-farm employment data for this Friday has become a focal point.

Scott told reporters that the market currently expects an increase of 163,000 jobs in August, up from 114,000 previously, with the unemployment rate falling from 4.3% to 4.2%, and hourly wage growth rising from 3.6% to 3.7%. A better-than-expected employment report will consolidate the prospect of an economic "soft landing" and a 25 basis point rate cut, which will be favorable for the U.S. dollar. On the contrary, data that falls short of expectations may stimulate expectations of a recession and increase the probability of a 50 basis point rate cut, thereby being bearish for the U.S. dollar and U.S. stocks. If the employment report is mixed, the unemployment rate may have a higher impact weight.

It is worth noting that the August employment data has been revised. In the 12-month period ending March 2024, the U.S. non-farm employment data was significantly revised down by nearly 820,000.

However, overall, institutions still believe that the U.S. economy has resilience. The previous rise in the unemployment rate is related to weather factors and is also related to the increase in labor supply. After the historically volatile months before the U.S. election, U.S. stocks are expected to return to appreciation, and the global stock market will also benefit in the context of U.S. rate cuts without a recession.

Jing Shun's Chief Global Market Strategist Harper (Kristina Hooper) told reporters, "In my view, the U.S. is very likely to avoid a recession." She said that the market expects the Federal Reserve to cut rates by about 200 basis points, which may provide greater momentum for risk assets in the coming months. In this environment, the market may expect the economy to re-accelerate at the end of 2024 or the beginning of 2025, which is expected to drive a strong performance of risk assets. Among them, cyclical stocks and small-cap stocks will at least modestly outperform; a weaker U.S. dollar may be favorable for international stocks; fixed income is rising, especially high-yield bonds, municipal bonds, and REITs.

The renminbi is expected to continue to strengthen along with the yen.

In the future, in addition to the U.S. market, the trend of the yen is also of great concern. Major institutions believe that the yen will continue to strengthen, but this time it may not have a huge impact on the global stock market, and the renminbi is expected to continue to appreciate.

The Oxford Economics Institute told reporters that the Bank of Japan may implement additional rate hikes in October, as the July meeting issued hawkish forward guidance. "After the rate hike, we expect the Bank of Japan to be more cautious, raising rates only once in 2025 and 2026, to reach a final interest rate of 1%."

The institution believes that although the unpopular yen weakness is somewhat relieved, politicians may be more concerned about the impact of stock market pullbacks and the impact on vulnerable groups (including families with limited income and micro-enterprises).

Yang Aozhèng said that the trend of the U.S. dollar weakening and the yen strengthening will be beneficial for the renminbi to maintain strength. Since the U.S. has been the most aggressive in raising interest rates, while the interest rates in Europe and the UK have only risen to around 4%, the Federal Reserve may cut rates by more than 200 basis points in the future, and the scope of rate cuts in Europe and the UK may be much smaller, which also determines the trend of the U.S. dollar weakening. It is not ruled out that the U.S. dollar index may fall below 100 in the future.Over the past two days, the US dollar/Japanese yen has almost given up all the gains from last week and is currently testing the previous support level near 144. If the 144 level breaks, it may continue to head towards the 140.75 area. Only a rebound above 147 could potentially reverse the downtrend. The US dollar/Chinese yuan remains at the 7.09 level, and with the continuous appreciation of the yuan against the US dollar, the potential "settlement effect" of exporters in the future may continue to drive the yuan to test the 7 mark.

Post a comment