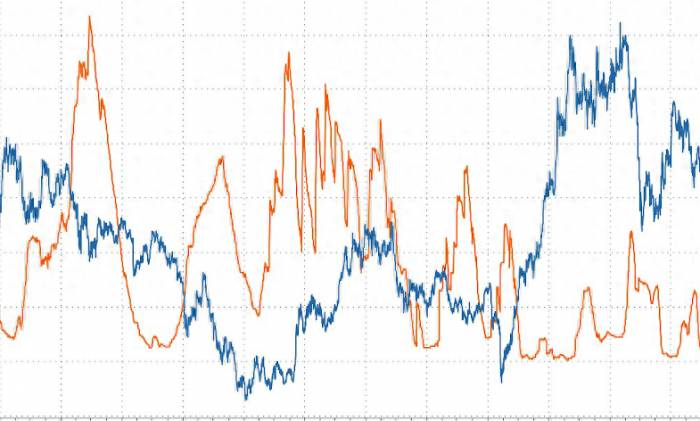

September has arrived, and the international financial market has started to short the US dollar in advance.

Wow, this is indeed a big issue! It seems that the Federal Reserve's "interest rate cut preview" has really "bamboozled" quite a few people. However, since the Federal Reserve has made its cards clear, then this so-called "financial war" is also unlikely to break out, right?

The imminent dollar war

The "dollar shorting game" that everyone is eager to try

Indeed, ever since the Federal Reserve signaled a rate cut, a large number of "smart funds" have been eager to take advantage of the opportunity to engage in a dollar "shorting" war. They believe that as long as the dollar depreciates, they can get a share of the "financial feast."

But it seems these people have forgotten a most basic fact - the dollar is a currency issued by the Federal Reserve itself, and its rise and fall are determined by the Federal Reserve. Would someone who sets the rules of the game really let themselves lose the game? I'm afraid that these speculative capitals will eventually become "leeks" to be harvested by the Federal Reserve.

Who is being played by the fake rate cut?

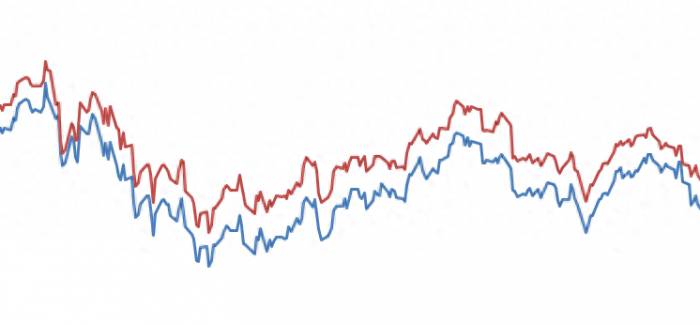

Moreover, the rate cut signal issued by the Federal Reserve this time is also a financial pressure test. The Federal Reserve just wants to see what the market's reaction would be if there really was a rate cut. Through this "probe," the Federal Reserve can better control the situation and prepare for the next policy step.

So, those who have laid out their positions in advance to short the dollar may have become the "leeks" in the eyes of the Federal Reserve. The Federal Reserve is using this message to identify who the most suitable "harvesting targets" for the dollar are.

The rate cut is just a shift in the battlefield.In summary, the Federal Reserve's signal of a potential interest rate cut this time does not necessarily mean that it will actually choose to cut rates. Its purpose is more about shifting the battlefield to alleviate short-term pressure for a rate cut. In the long run, the Federal Reserve's bottom line is absolutely unyielding - it cannot allow its financial policy independence to be compromised.

Those who think they can get a share of the pie from the Federal Reserve may be disappointed. The future direction of the US dollar is still determined by the Federal Reserve. The only way to truly defeat the Federal Reserve is through "de-dollarization," completely breaking free from the dominance of the US dollar.

Final outcome: The Federal Reserve continues to reap the benefits.

Thus, the Federal Reserve's "trial balloon" of expected operations this time can be considered quite "ingenious." On one hand, it eases short-term pressure for a rate cut, and on the other hand, it can identify the next batch of "fodder." When these people fall for it and the US dollar exchange rate rises again, the Federal Reserve's "financial harvesting" project will be launched.

This is where the Federal Reserve's "great wisdom appears foolish." If you dare to take action against it, it lets you make the first move. And the result? One by one, they all become "fodder," returning to the realm of the US dollar. It's truly astonishing!

The Federal Reserve's ultimate goal: Protect the hegemonic status of the US dollar

It seems that the Federal Reserve's "interest rate cut preview" this time is a brilliant move. On one hand, it alleviates external pressure for a rate cut, and on the other hand, it can accurately target the next "harvesting objects." After all, no one dares to really take action against the Federal Reserve, the old master.

It is not difficult to find that the fundamental purpose of the Federal Reserve is actually to maintain the hegemonic status of the US dollar. After all, the US dollar is the global currency issued by the Federal Reserve, and its value fluctuations are determined by the Federal Reserve. To truly break free from the rule of the US dollar, the most critical step is to promote the "de-dollarization" process.

However, "de-dollarization" is not an easy task. First, it requires the enhancement of economic strength and discourse power of various countries, and second, it also requires the establishment of a new international monetary system. It is very difficult to shake the status of the US dollar in a short period of time.

Therefore, it is no surprise that the Federal Reserve has taken the initiative in this round of the "dollar war." It can not only accurately control the trend of the US dollar exchange rate but also use the "speculation" of various speculative capitals to achieve continuous control over the global financial market.In this process, those speculators who attempt to redeem themselves by shorting the US dollar are nothing more than fodder for the Federal Reserve. The ultimate goal of the Federal Reserve is to preserve the hegemony of the US dollar and maintain its financial discourse power.

It's no wonder that many countries are seeking to break free from their dependence on the US dollar, initiating a "de-dollarization" movement. However, to truly shake the foundations of the Federal Reserve, there is still a long way to go. After all, in this global financial system dominated by the US dollar, the position of the Federal Reserve is as solid as a rock.

Post a comment