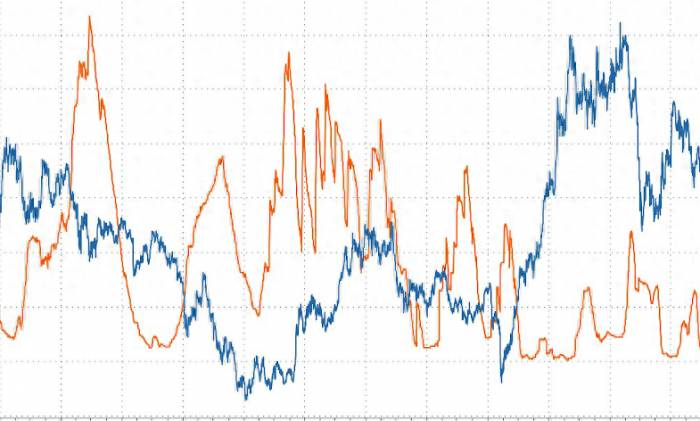

Tonight, global markets have plummeted again!

Now everyone is thoroughly panicked!

Bad news keeps coming, with bank stocks plunging collectively.

Today, the A-share market continued to decline, with the Shanghai Composite Index nearly losing the 2800-point threshold, and only barely holding on at the end with a hard pull by the "national team." It seems that this round of decline is far from over, and everyone is getting restless.

Bank stocks are even more unbearable to watch, plummeting all the way and dragging down the overall market. There are mainly two reasons for this:

First, there are domestic rumors about reducing mortgage interest rates. Although indirectly denied by China Merchants Bank, it is highly likely to be implemented in the future. This directly hits the banks' interest spread income.

Second, the Federal Reserve is about to start cutting interest rates, which will also squeeze the banks' interest margins. Recently, Warren Buffett has been frantically selling U.S. bank stocks, indicating that the outlook is not optimistic.

After the collapse of this "group hug game," it is natural to make up for the drop. The bank stocks that were previously hyped up are now going to "fall back to their true value." However, for the entire A-share market, the correction of bank stocks is actually a good thing.

Don't panic, rotation is still ongoing.

As for any good news in the A-share market, it is that thematic stocks are still soaring in turns.The news of China Shipbuilding's acquisition has stimulated a collective rise in military industry stocks; the e-cigarette concept has also gone wild due to related news; even Huawei concept stocks and solid-state battery concepts have strengthened once again.

However, most of these hot spots are short-term speculations, and to make real money, one must be cautious. After all, overall, the market is still in a state of competition for existing funds, and mainstream funds are still on the sidelines.

Overseas stock markets are also suffering.

Tonight, global stock markets have collectively plummeted, which has once again raised concerns about a "hard landing" in the US economy.

The US manufacturing PMI data for August fell short of expectations, triggering this round of stock market disaster. More significant economic data will be released in the coming days, which could potentially cause greater fluctuations.

What's more unsettling is that the Bank of Japan has actually said it will raise interest rates. This was one of the main culprits that led to the "Black Monday" crash on August 5th.

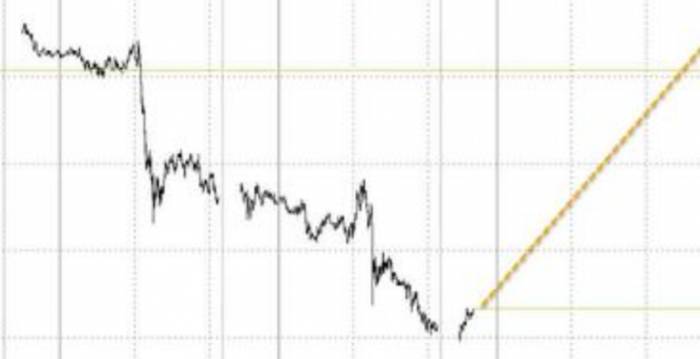

So, it is quite likely that A-shares will follow the US stock market down. As a battleground for existing funds, A-shares find it difficult to stand alone.

In summary, this round of sharp decline is not accidental. Various bearish factors are emerging one after another, and the market is filled with panic. Investors should maintain a cautious attitude and operate carefully. The "winter" of the market is far from over.

More bad news is waiting for us.

It seems that the golden September and October market has not arrived as expected. Instead, one bearish news after another is coming in succession, causing great alarm.The latest economic data indicates that the U.S. manufacturing PMI index has significantly underperformed expectations, sparking market concerns about a potential "hard landing" for its economy. In the coming days, as more significant data is released, these concerns are bound to intensify further.

At this very moment, Japan, the "troublemaker," has once again inserted itself into the situation. The Bank of Japan's governor has surprisingly stated the intention to continue raising interest rates, which is one of the main culprits behind the stock market plunge in August this year. It appears that the factors troubling the global economy are far from being eliminated.

It can be said that the external environment facing China's A-shares has deteriorated once again. With the continuous decline of the U.S. stock market, A-shares, as the "second fiddle," are likely to be dragged down again.

To be honest, it is really difficult for investors to make any good moves in this situation. Bank stocks are catching up on their declines, and thematic stocks are also hard to maintain a long-term upward trend, with market sentiment clearly worsening. How should investors respond to this?

Only by being cautious and well-planned should one act.

I believe that in this uncertain environment, investors should maintain a cautious attitude. After all, there are too many bearish factors at present, and it is difficult to resolve them one by one.

Since mainstream capital is still on the sidelines, it might be wise to follow the crowd and wait patiently for the right moment. After all, no one can predict what will happen next.

It might even be worth considering shifting some funds to relatively safer assets, such as cash and bonds. This can help to avoid some risks while not completely missing out on potential future opportunities.

In summary, in such an environment, caution and patience are essential qualities for investors. Only by conducting thorough risk assessments can one navigate steadily through the storm.

Post a comment