For stock markets around the world, the period from September to November is typically one of high uncertainty and significant volatility. After the first interest rate cut in several years, global stock markets are swayed by every move made by American politicians and the Federal Reserve.

For Chinese assets, investors are most concerned about the impact of the Federal Reserve's interest rate cut on A-shares. With the Federal Reserve's September rate cut essentially confirmed, the logic that "a U.S. rate cut is good for A-shares" has begun to be widely discussed, and there is even a claim that "the rate cut will bring back trillions of dollars, benefiting A-shares."

The Federal Reserve cuts interest rates, foreign capital flows back, A-shares receive an influx of funds, and the stock market soars. This logic seems very coherent and aligns perfectly with the current desires of A-share investors, who are indeed in need of an influx of funds, especially those with a high risk appetite. If there really is a flow of foreign capital back into A-shares, then a significant rise in the stock market is entirely expected and fits perfectly with the mentality of investors. Thus, this logic has a broad market appeal, and the logical deduction appears to be without issue.

However, the reality may not be so optimistic. The narrative of "east rising, west falling" due to interest rate cuts has been told countless times over the past few years, but reality often contradicts it. This article will explain why "not so much capital will flow back" and why the impact on domestic markets, whether in stocks or other areas, is not as significant.

Recently, the well-known proponent of the "dollar smile theory," Stephen Jen, stated in a Bloomberg interview that in recent years, Chinese companies may have earned a substantial amount of dollars overseas and accumulated them for the purchase of high-yielding dollar assets. Once the Federal Reserve begins to cut interest rates, the attractiveness of these high-yielding dollar assets will diminish, thereby promoting at least a trillion dollars in capital to flow back to China.

It is this logic that has given rise to the claim that "trillions of dollars will flow back, benefiting A-shares."

So, let's first examine whether Chinese companies have indeed accumulated a large amount of foreign exchange overseas.

The reality is that in the past two years, after domestic companies have earned foreign exchange from exports, the proportion of currency settlement has indeed been decreasing. Chinese companies have indeed accumulated a considerable amount of assets overseas. In the past two years, the domestic economy has largely been driven by exports, with not only the traditional "old three" of clothing, furniture, and home appliances seeing a significant increase in exports, but also the new "three" of new energy vehicles, lithium batteries, and photovoltaics shining brightly. It is precisely because of this that many trade frictions have arisen, and now many countries have begun to impose high import tariffs on domestic products, or countervailing duties, anti-dumping duties, etc. The surge in exports has allowed domestic companies to earn a large amount of foreign exchange. If it were a dozen years ago, according to regulatory provisions, companies would not be allowed to retain this foreign exchange and would have to exchange it for RMB. However, since January 1, 2011, companies have been allowed to keep the foreign exchange earned from exports overseas without having to repatriate it. That is to say, companies can freely choose how to use this earned foreign exchange based on exchange rate fluctuations and their own needs (whether to exchange it for RMB, invest directly overseas, or even hold dollars directly overseas).

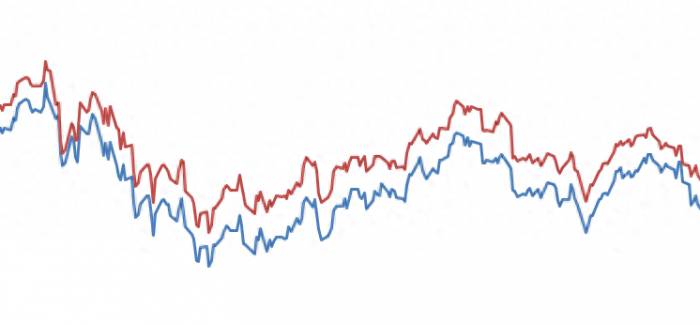

In recent years, as the RMB exchange rate has continued to depreciate, the willingness of export companies to exchange dollars for RMB after earning them has genuinely decreased. Looking at the ratio of goods trade settlement amount to goods trade income in the balance of payments, this ratio has indeed been gradually decreasing in recent years. This ratio also implies that a large number of export companies, after earning dollars, have not exchanged all of them for RMB but have kept this part of the funds overseas by holding foreign currencies.

From this chart, it can be seen that after 2020, this ratio has been fluctuating downwards, and since 2022, it has declined rapidly.The reasons are not complicated. First, in recent years, the value of the renminbi has weakened, and converting to renminbi would result in devaluation. Second, in recent years, the US dollar has been a high-yield asset, with the annualized deposit interest rate for US dollars once exceeding 5%, which naturally yields a higher return compared to the renminbi. Third, companies themselves have an increasing demand for overseas investments, and holding US dollars is more convenient.

Driven by these reasons, more and more companies are not choosing to convert the US dollars they earn from exports into renminbi. As a result, these companies have accumulated a large amount of US dollar assets overseas. According to institutional estimates, the total amount of these "unconverted" funds is about one trillion US dollars, compared to before 2022. For example, calculations by CICC show that since 2022, the ratio of the amount of funds converted to the export volume has decreased by about 10 percentage points compared to the historical average. From January 2022 to July 2024, the total amount of these "less converted" funds is approximately $933.2 billion.

If the Federal Reserve lowers interest rates in the future and the renminbi enters an appreciation range, then the logic of "holding US dollars when the renminbi is weak" will be reversed. These companies with a large amount of US dollars may speed up the conversion, especially at the end of the year, when they need to convert US dollars into renminbi for upstream loans, repaying principal and renewing loans to banks, and paying year-end bonuses to employees, thus leading to a return flow of renminbi.

This is one of the most important reasons for the so-called "trillion US dollars of funds flowing back to China." It is also worth mentioning that different institutions have very different forecasts for this figure. For example, Macquarie Group estimates this number to be over 500 billion US dollars; ANZ estimates it to be 430 billion US dollars; Goldman Sachs calculates that even including the US dollar assets held by residents, the amount of US dollars hoarded by Chinese companies and residents from mid-2022 to 2024 does not exceed 600 billion US dollars, so the amount of US dollar assets that can be converted is naturally even less; Wang Ju, Head of Interest Rate and Exchange Rate Strategy for Greater China at BNP Paribas, believes that this number may be far less than a trillion.

This also shows that the market generally agrees on the repatriation of US dollars, but there is a significant difference of opinion on the scale.

Whether there will be a repatriation of US dollars for renminbi conversion depends on the reasons mentioned earlier for companies holding US dollars, including exchange gains or losses from the appreciation of the US dollar, higher yields from US dollar assets, and their own investment needs.

First, let's look at the exchange rate. For export companies, a devaluation of the renminbi means increased earnings, which is beneficial for improving the company's profit level. Conversely, if companies expect the renminbi to appreciate in the future, to avoid exchange losses, they would definitely convert the received US dollars. Will the renminbi exchange rate continue to appreciate? This question is quite complex, and this article will not discuss it in detail. Here is a quote from the regulatory authority:

"On August 9, the central bank released the '2024 Second Quarter China Monetary Policy Implementation Report,' which proposed to monitor and analyze cross-border capital flows, adhere to a bottom-line thinking, take comprehensive measures, stabilize expectations, prevent the formation of one-sided consistent expectations and self-reinforcement, resolutely guard against the risk of exchange rate over-adjustment, and maintain the basic stability of the renminbi exchange rate at a reasonable and balanced level. At an earlier Politburo meeting on July 30, it also mentioned 'to maintain the basic stability of the renminbi exchange rate at a reasonable and balanced level.'"

Note that the term "stability" is used here, whether it is appreciation or depreciation, which is not desired by the regulatory authorities. After all, if the appreciation is too much, the suppression of exports is very significant, which is absolutely unbearable for the current economy that mainly relies on exports. Therefore, once there is an excessive appreciation or depreciation, the central bank will stabilize the exchange rate through various means. Thus, the conclusion is that it is not realistic to expect a significant appreciation of the exchange rate. It is even possible that the current exchange rate has already reached a level close to equilibrium.

Second, let's look at the logic of higher returns from holding US dollars. This logic also exists in export companies, and many companies will increase their income by "depositing US dollars in high-interest deposits and borrowing low-interest renminbi loans."Taking the 2023 annual report of a certain listed company as an example, nearly 90% of its cash and cash equivalents are in the form of US dollar deposits:

On the other hand, the company's daily operations and working capital are mainly met through medium and short-term loans in Chinese yuan.

By adopting the method of "borrowing Chinese yuan loans to maintain operations and production, and holding high-interest US dollar assets to earn income," the company achieved an interest income of 291 million yuan during the reporting period, a year-on-year increase of 169%. Of course, using domestic loans to make up for daily operations also generates some interest expenses, but overall, the interest income it obtains is far greater than the interest costs that need to be paid.

Therefore, it can be seen that the interest rate differential between China and the United States has brought different choices for corporate settlement and sale of foreign exchange. If this interest rate differential gradually narrows or even reverses in the future, then companies obviously have the motivation to reverse the transaction and hold Chinese yuan instead.

However, in reality, for a considerable period of time, there will still be a significant interest rate differential between China and the United States. Before this differential completely disappears, there will still be transactions of "borrowing low-interest Chinese yuan loans and holding high-interest US dollar deposits."

Finally, based on the overseas investment needs and operational requirements of export companies, a large part of the foreign assets will be transformed into fixed assets abroad, becoming a part of the company's overseas investment. The scale of this "foreign assets held domestically" will also continue to grow in the future.

Looking at the scale of domestic companies going global, in 2023, the number of non-financial overseas enterprises directly invested by China reached 7,913, a significant increase of 1,483 compared to 2022. The amount of non-financial foreign direct investment reached 130.13 billion yuan, second only to the last wave of going global in 2016. Especially in recent years, the enthusiasm for regions such as Southeast Asia and Latin America has led to a considerable amount of foreign exchange being transformed into local fixed assets, and this part of the money will not come back.

In fact, this situation is very similar to Japan. There are quite a few studies that believe that although Japan's GDP did not grow much during the so-called "lost 20 years," it "recreated a Japan" overseas through globalization and layout. This conclusion is controversial, but it is undeniable that foreign assets are indeed an important part of a country's residents' wealth. The current wave of Chinese companies going global is also a manifestation of this.

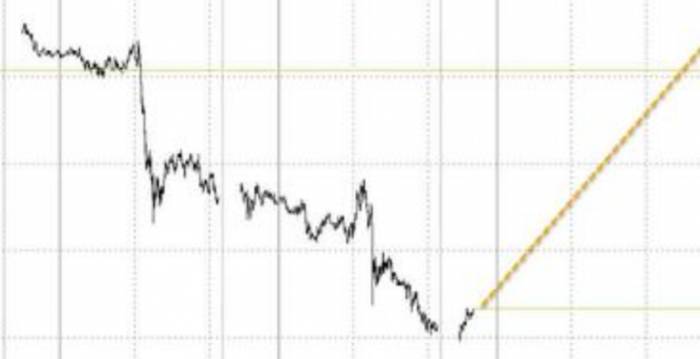

Therefore, in general, the wish for a "trillion dollars to flow back" is beautiful, but it may not be as optimistic as simply deduced. The idea of funds flowing back into A-shares is more like an imagination. Overly optimistic transactions are full of risks that do not meet expectations.

Of course, this does not affect my optimism about the A-share market. The current more positive policy stance and the already improved fundamentals are drowned in pessimistic sentiment. Excessive optimism is a risk, and so is excessive pessimism.Selling in the "booming crowd" is difficult, and buying in the "neglected times" is equally challenging. Yet, these are often the right choices.

Post a comment