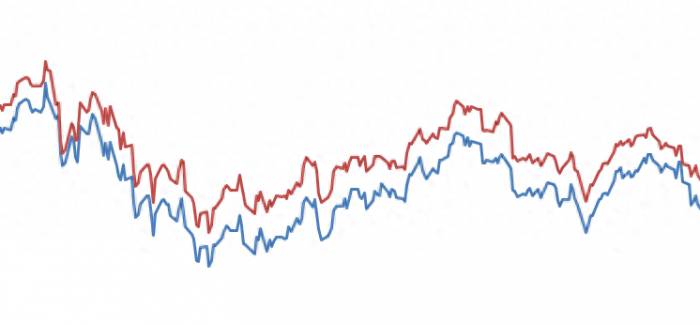

This year, copper prices have shown a more complex pattern of fluctuations. From the beginning to the middle of the year, influenced by a variety of macroeconomic and industry factors, copper prices have experienced several rounds of rising and falling. Entering the second half of the year, especially now in September, with subtle changes in global economic data and adjustments in market expectations, copper prices have once again become a focal point of market attention.

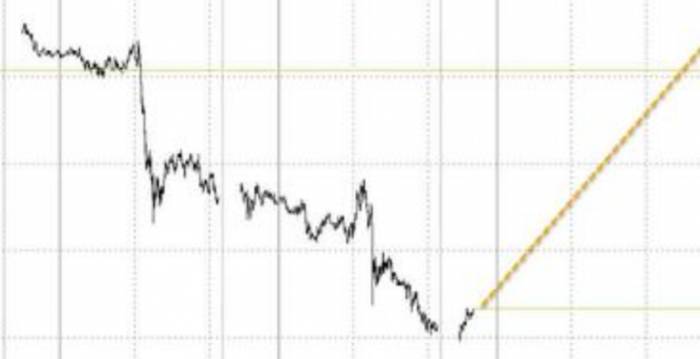

The macroeconomic environment is one of the core factors affecting the fluctuation of copper prices. In 2024, the expectation of a slowdown in global economic growth has been looming over the market, and the uncertainty of the high-interest-rate environment overseas has put pressure on copper prices. However, the unexpected decline in U.S. inflation and the strengthening expectation of the Federal Reserve's interest rate cuts have provided a breather for copper prices.

Specifically in September, Powell acknowledged at the central bank's annual meeting that the United States has been successful in controlling inflation, and he expects the CPI to fall to 1.5% by mid-2025. This optimistic expectation has boosted market sentiment, providing short-term support for copper prices. At the same time, improvements in some overseas economic data have also eased the market's recession fears, further supporting copper prices.

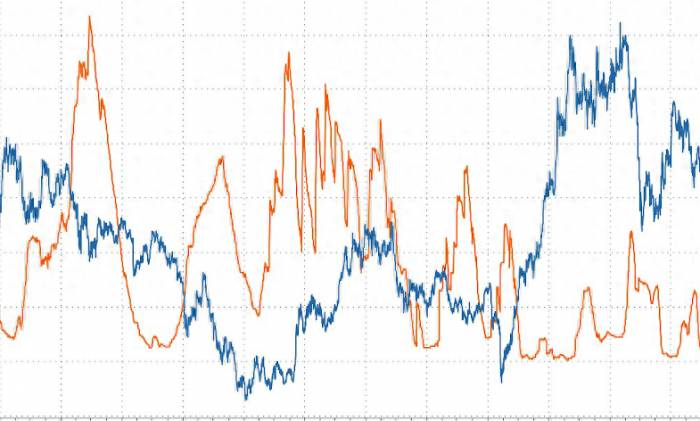

From an industry perspective, the supply and demand situation of copper directly determines its price trend. In recent years, although the growth rate of global copper consumption has fluctuated, it has generally maintained a stable increase. In particular, the strong demand from the domestic real estate and new energy sectors has provided strong support for copper prices. However, as the global economic growth slows down, there are signs of a marginal decline in the growth rate of copper consumption.

On the supply side, the issue of tight supply of copper concentrate still exists, and the competition between the smelting and processing ends for recycled copper is becoming more intense. At the same time, the commissioning of new production capacity has gradually increased the supply of refined copper, but the overall supply growth rate is still difficult to meet the rapidly growing demand.

Changes in the monetary and financial markets also have a significant impact on the fluctuation of copper prices. The Federal Reserve's interest rate hike and cut cycles directly affect the strength of the U.S. dollar, which in turn affects copper prices through the exchange rate channel. In addition, fluctuations in the financial markets, such as the performance of the stock and bond markets, can also affect investors' risk preferences, thereby affecting copper prices.

In September, with the strengthening expectation of the Federal Reserve's interest rate cuts, the U.S. dollar index has come under pressure, providing upward momentum for copper prices. However, at the same time, the rebound in the global stock market has also boosted market confidence, which is conducive to the stabilization and recovery of copper prices.

Inventory levels are one of the important indicators reflecting the supply and demand relationship in the copper market. In recent years, due to the strong demand from the real estate and new energy sectors, copper inventories have been at a historical low for a long time, providing strong support for copper prices. With the commissioning of new production capacity and the marginal decline in demand growth, inventory levels are expected to gradually rise, thus putting pressure on copper prices.

In the spot market, the competition between recycled copper and refined copper is becoming more intense, and the increase in recycled copper has had a certain impact on the refined copper market. The reduced stability of import supplements and the increase in the proportion of non-deliverable products have also intensified the fluctuations in the spot market.

In the short term, the trend of copper prices will still be influenced by multiple factors. On the one hand, the continuous improvement of U.S. economic data and the strengthening expectation of the Federal Reserve's interest rate cuts will provide upward momentum for copper prices. On the other hand, the expectation of a slowdown in global economic growth and subtle changes in the supply and demand relationship may also put pressure on copper prices. In the short term, copper prices may exhibit a pattern of wide-range oscillation.In the long term, the trend of copper prices will increasingly depend on the pace of global economic recovery and the progress of the new energy transition. As the global economy gradually recovers and the new energy industry develops rapidly, the demand for commodities such as copper is expected to continue to grow. However, supply-side bottlenecks still need attention, especially the increase in the cost of copper ore mining and the intensifying competition for recycled materials.

Under this background, copper prices may exhibit a steady upward trend. However, it is important to note that the complexity and uncertainty of the global economic environment will also have a significant impact on the trend of copper prices. Fluctuations in copper prices are influenced by a variety of factors, including macroeconomic conditions, industry supply and demand, currency, and financial markets. In the short term, copper prices may experience a wide range of oscillations; in the long term, with the recovery of the global economy and the advancement of the new energy transition, copper prices are expected to rise steadily. The above content is for reference only and represents personal opinions, which may not necessarily be correct.

Post a comment