On September 5th, the domestic refined oil price adjustment window opened as scheduled. Reporters from the Economic Guide learned that at 24:00 on September 5th, the retail price limits for gasoline and diesel will be lowered, with gasoline being reduced by 100 yuan per ton and diesel by 100 yuan per ton. This translates to a decrease of 0.08 yuan per liter for 92-octane gasoline, 95-octane gasoline, and 0-kilogram diesel.

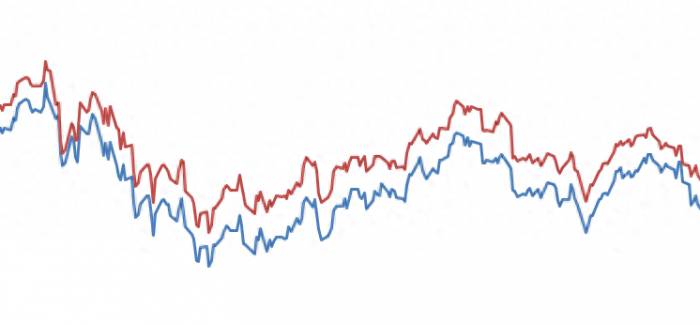

Zhuochuang Information's refined oil analyst, Yu Yaxin, stated that since the beginning of this pricing cycle, the temporary closure of domestic oil fields and exports in Libya, affecting a supply of 1 million barrels per day, has caused oil prices to surge due to market concerns. However, as various parties condemned the situation and the market generally expected a gradual recovery, the geopolitical risk premium was given up. Later, due to a sharp decrease in Libyan crude oil production, European and American crude oil futures rebounded strongly. Nevertheless, towards the end of this pricing cycle, there were signs that the Libyan parties would reach an agreement to resolve disputes, leading to a more than 4% drop in international oil prices.

Jinlian Chuang's crude oil analyst, Han Zhengji, indicated that the disruption of Libyan oil supply and the commitment of some member countries to cut production to offset overproduction have counteracted the impact of weak demand. OPEC+ will continue to increase oil production as planned from October. Eight OPEC+ member countries plan to raise production by 180,000 barrels per day in October, which is part of the beginning to lift the recent 2.2 million barrels per day production cut, while maintaining other production cuts until the end of 2025.

However, a preliminary survey released on September 3rd showed that last week's estimated decline in US crude oil and gasoline inventories, while distillate fuel inventories may increase. The average forecast of six analysts interviewed suggested that US crude oil inventories fell by about 600,000 barrels for the week ending August 30th.

Additionally, market survey data revealed that the Organization of the Petroleum Exporting Countries (OPEC) saw its oil production drop to the lowest since January in August, as domestic unrest disrupted Libyan oil supplies, exacerbating the impact of the OPEC alliance's voluntary production cuts. The survey found that OPEC's oil production in August was 26.36 million barrels per day, a decrease of 340,000 barrels per day from July. According to the survey, this is the lowest output since January 2024.

This round marks the seventeenth price adjustment in 2024 and will also be the sixth decrease of the year. After this adjustment, the pattern of refined oil price adjustments in 2024 will be "seven increases, six decreases, and four standstills."

For private car owners and logistics companies, this adjustment reduces costs. Calculated for a typical private car with a 50-liter fuel tank, owners will save about 4 yuan after this adjustment when filling up a tank; for a city car model consuming 8 liters per 100 kilometers, the average cost per 100 kilometers decreases by about 0.64 yuan. For large logistics transport vehicles carrying 50 tons, the fuel cost per 100 kilometers decreases by about 3.2 yuan on average.

Looking ahead, market concerns about the economic and demand outlook continue to ferment. The traditional peak season for fuel consumption in the United States will end in early September, and it is still unclear whether OPEC+ will extend production cuts. It is expected that the probability of a decrease in the next round of refined oil price adjustments is relatively high.

Based on the current level of international crude oil prices, the next round of refined oil price adjustments will start with a downward trend and a significant decrease. The next pricing window will open at 24:00 on September 20, 2024.

Leave a Reply